The Economy Giveth, and Inflation Taketh Away

Executive Summary

Given the reduced expectations of monetary easing, still-sticky inflation, and risks around two ongoing wars and the upcoming election, the economy and stock market have been more resilient than many people expected. Although consumer and macroeconomic growth remain strong, we are seeing some signs of slowing or at least normalizing.

Corporate earnings growth remains strong, providing a fundamental basis for the market’s rise. However, the narrative around earnings and the ongoing equity rally can be boiled down to a narrow group of sectors and industries, with most of the key leaders powered by the optimism around artificial intelligence (AI).

Government spending levels continue to rise, a reality that provides support to the market but also drives longer-term concerns, especially given higher-for-longer interest rates. Inflation, which surged and brought the recent rise in financing costs, remains higher than the U.S. Federal Reserve (Fed)—and most consumers—would like. In the first half of 2024, expectations of cooling prices have been pushed back, repeatedly, replaced by worries that higher costs—not just for goods and services but also debt levels―may be starting to weigh on consumer and corporate spending.

We’re also concerned about asset price inflation and are closely monitoring stretched valuations, market concentration, and the impact that a changing interest rates course could have on what’s become a long bull market.

Economic and Investment Review

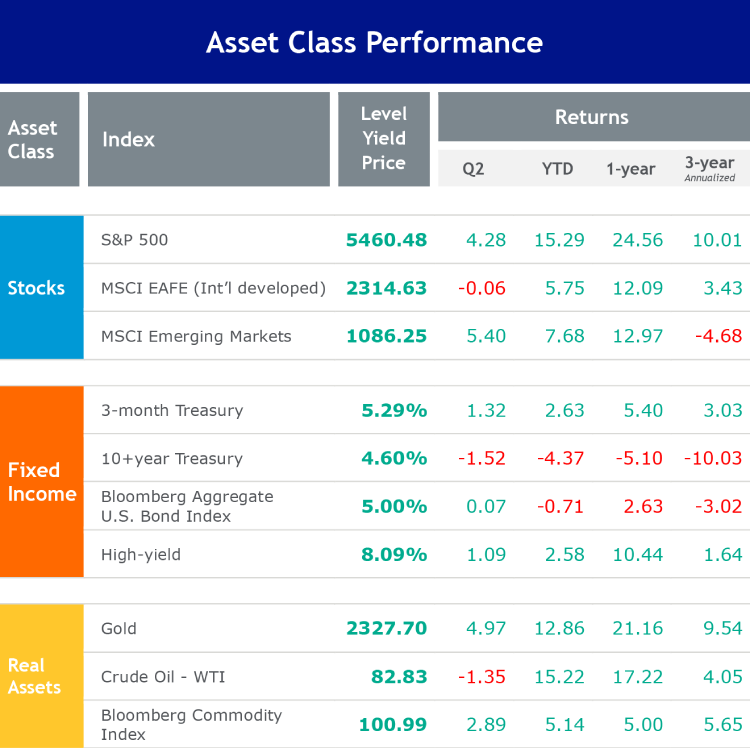

Investors shrugged off concerns about sticky inflation and fading expectations of interest rate cuts, with key large-cap U.S. indexes reaching multiple all-time highs during the second quarter. Semiconductor companies’ stocks were the key drivers for the S&P 500 Index, while AI themes boosted other sectors, such as utilities, benefiting from rising electricity demand for AI data centers.

International developed stocks finished the quarter essentially flat, but emerging markets rebounded nicely, boosted by strong stock performance in Taiwan, India, and China. U.S. government bond market returns were restrained as yields rose, but high-yield bonds eked out gains.

Commodity prices, up since the beginning of the year, rose slightly last quarter as gold prices hit record highs amid concerns over geopolitical risks, government debts, and stockpiling by central banks. Copper prices also flashed to record levels in May due to supply concerns. Oil prices ended the quarter slightly down but remained elevated, supported by a robust economy and supply risks from Middle East conflicts.

Source: FactSet, 3-month Treasury – ICE BofA U.S. Treasury Bill (3 M),10+ year Treasury – ICE BofA U.S. Treasury (10+ Y), U.S. Aggregate – Bloomberg U.S. Aggregate, High Yield – Bloomberg U.S. High Yield – Corporate, Gold – NYMEX Near Term, Crude Oil – NYMEX Spot

Blue Trust Insights

Markets Continue to Rally, but Risk Is Rising Too

The equity bull market continued during the second quarter, despite still-fading expectations for interest rate cuts by the Fed, ongoing risk surrounding multiple geopolitical events, volatile bond yields, and even an April stock market pullback. The S&P 500 ended June up 30.2% since October 2023 and up almost 57% since its post-pandemic low in October 2022. These gains are a testament to the power of strong corporate earnings, the enthusiasm around AI, and the economy’s resilience.

However, we must point out that market gains have been particularly concentrated. The so-called Magnificent Seven (M7)―Alphabet, Amazon, Apple, Microsoft, NVIDIA, Meta Platforms, and Tesla―have driven over half of the index’s gain year to date, after accounting for nearly two-thirds of the S&P 500’s return in 2023. Although the concentration is concerning, the rise has been somewhat justified as members of the M7 comprised the majority of the index’s earnings growth through the first half of the year.

Looking at the macroeconomic landscape, we see reasons for caution. First, investors entered 2024 expecting as many as six or seven rate cuts. Midway through the year, the projection is down to one or two. The reality that the market has thrived in the wake of the Fed’s 2022-2023 tightening cycle is unusual by historical standards. It is also surprising that the market has continued to show resilience in 2024, even as rate cut expectations shifted further and further into the future.

Cracks in the Resiliency?

We also see some concerning signs beginning to percolate around the economy, which may merely indicate normalization rather than weakness. For example, first-quarter gross domestic product (GDP) growth was revised down to 1.4%, amid softer consumer spending. More recently, job growth has slowed, unemployment claims have risen, and personal interest expense has spiked. Meanwhile, credit card balances are rising, and delinquency rates for credit cards and car loans are increasing. Although the trend in some economic data points is concerning, many have merely returned to pre-pandemic levels, perhaps suggesting normalization rather than a recession is near.

The rising cost of borrowing is impacting consumers and companies. However, in our view, rising rates haven’t slowed spending as much as expected because the damage has been controlled. Most consumer debt is in mortgages, many of which carry low interest rates from prior to 2022. Redfin reports that 75% of homeowners’ rates are less than 5%, with nearly 60% below 4% and 22% below 3%. Many companies, especially large ones, also secured low-rate loans, though smaller firms with more floating-rate financing may be feeling more pressure.

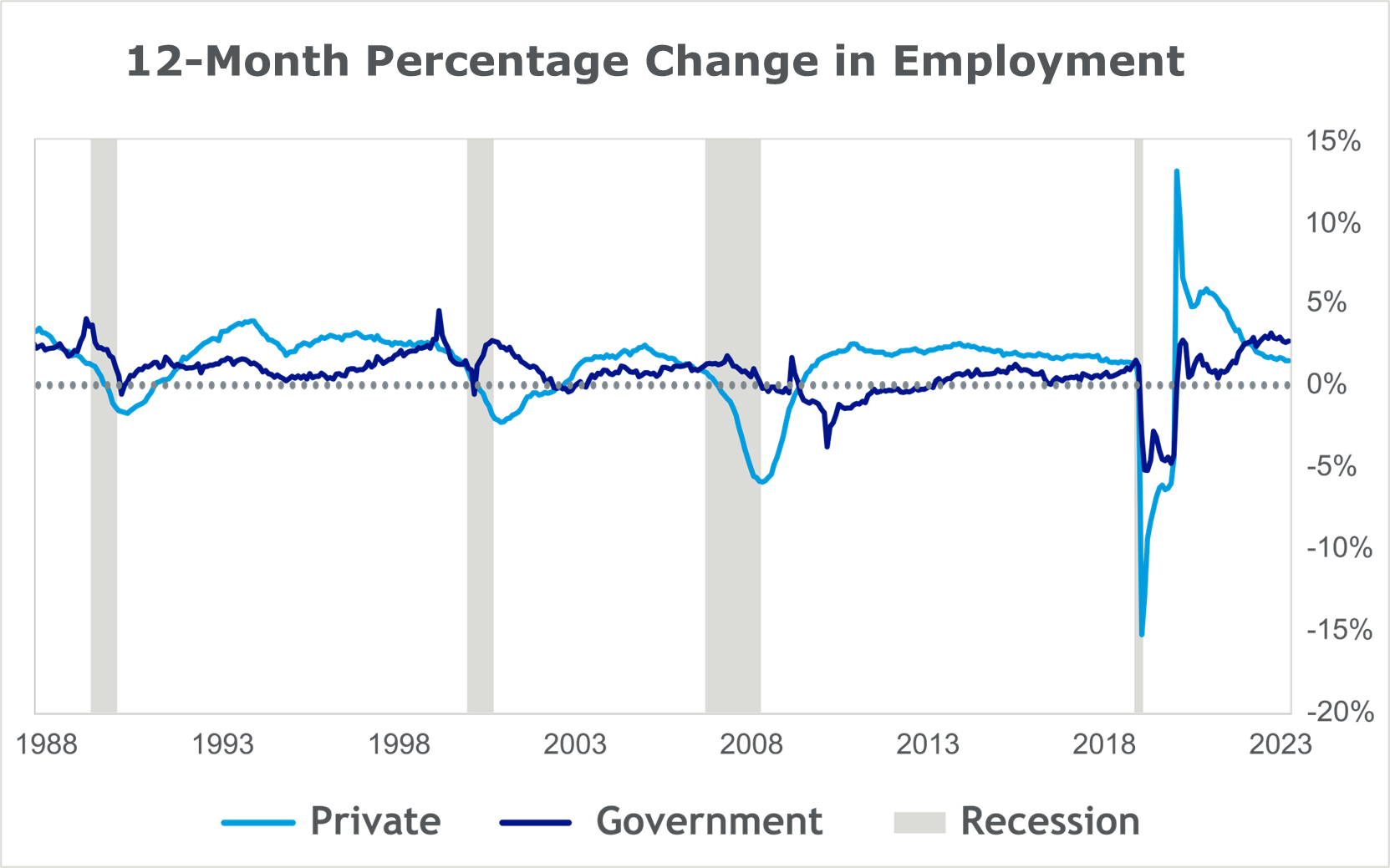

The strong jobs market, which expanded in June for the 42nd consecutive month, has helped buy the Fed more time to assess inflation data and trends. However, unemployment—while still historically low—rose from 3.5% in mid-2023 to 4.1% in June, the highest in more than two years. Through June, in the last 12 months, government job growth (2.7%) has outpaced the private-sector rate (1.5%). Historically, that trend signals weakening economic conditions.

Source: Federal Reserve Bank of St. Louis

The Long Fiscal Tail

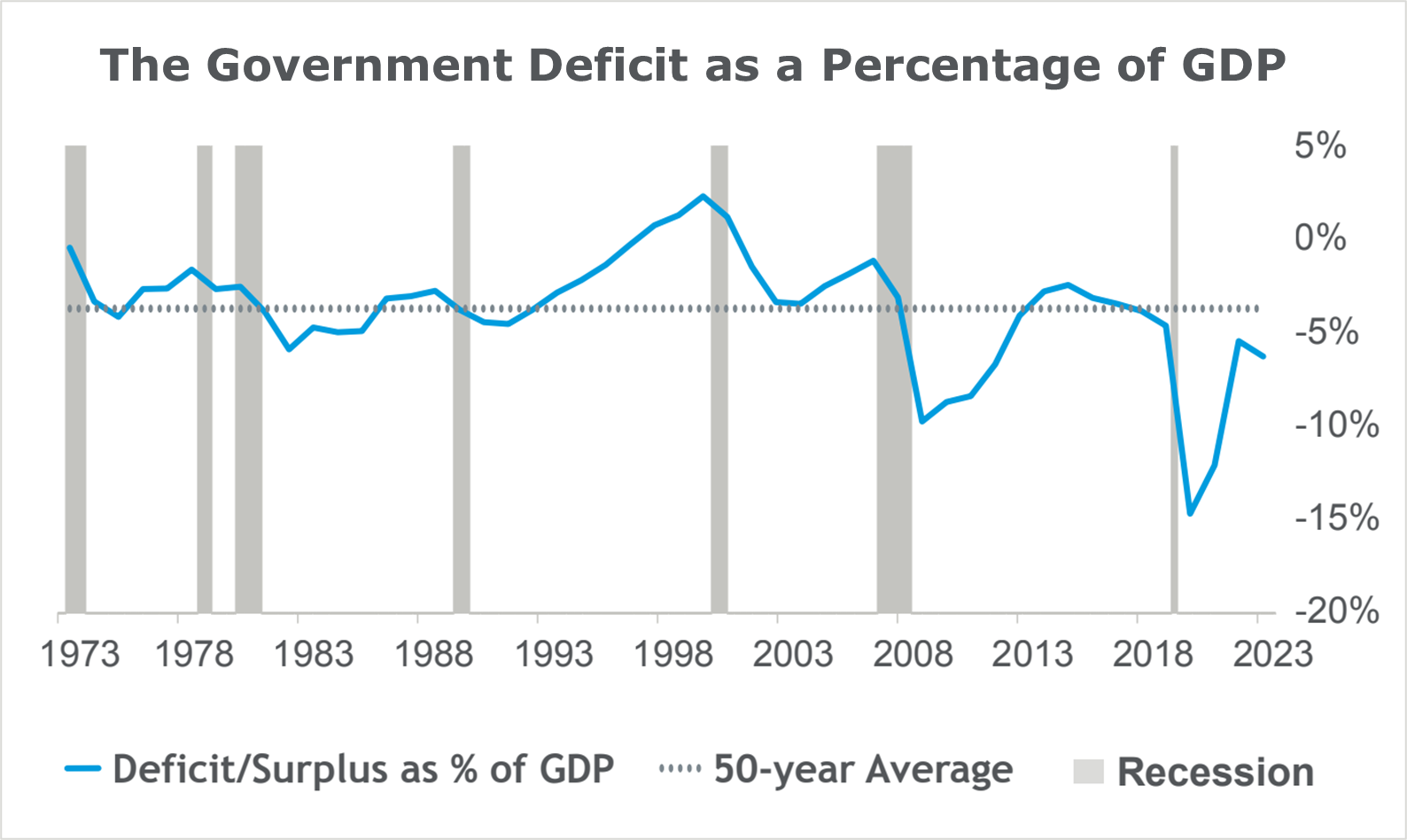

Government policy—in the form of very high spending—has also supported economic growth. The federal budget deficit is currently as large as it’s ever been outside of a war or recessionary period. Deficit spending rose to more than 6% of GDP in 2023. In June, the Congressional Budget Office increased its 2024 U.S. budget deficit prediction to $1.9 trillion for a deficit-to-GDP ratio of 6.7%. The increase came after incorporating recent additions to government spending, including student loan forgiveness and aid to foreign nations. Government spending continues to benefit the economy, for now, but the cost of financing it has risen sharply. The government’s interest payments will be close to $900 billion in 2024 and are increasing rapidly in forward projections. In the long run, these mounting debts are risky and unsustainable.

Source: Federal Reserve Bank of St. Louis

Investor Implications

At Blue Trust, we don’t try to time the market, and we avoid chasing performance. We’re more concerned about valuations, the possibility of a bubble in some of the large, leading stocks, and higher-for-longer interest rates.

We know that when a stock, sector, or style is overpriced, future growth tends to be limited. While we have exposure to many of these stocks, including the M7, we’re careful not to overweight them. More broadly, we stick to our belief in diversification and continue to seek growth opportunities with reasonable valuations.

We are also cautious when sectors have extraordinary valuations and rapid price increases, like we are seeing in technology and growth stocks with M7. These metrics lead us to ponder how long these companies can sustain this success. This concentration of market gains in a handful of mega-cap stocks has created a situation where a correction in these stocks could have significant repercussions for broader market indices.

High interest rates tend to weigh on future earnings, which are the fuel that propels stocks. Still, FactSet’s June 2024 analyst projection for S&P 500 earnings growth stood at 11.3% in 2024 and 14.4% in 2025, which is higher than at the end of 2023. Two consecutive years of double-digit earnings growth is rare, happening only twice since the Great Recession in 2007-2009.

Inflation Is Still Elevated

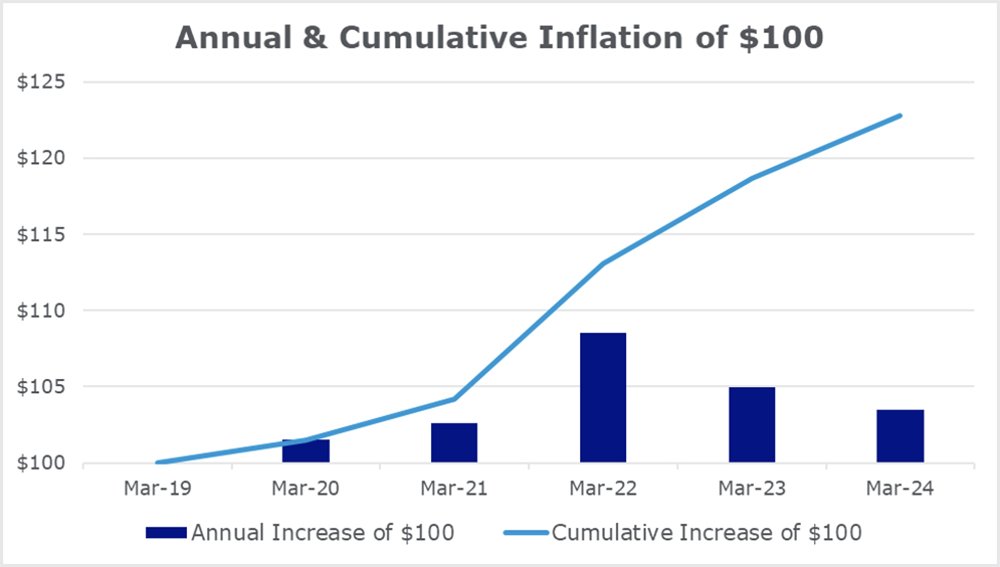

Inflation, which peaked in 2022 and has been cooling slowly, remains front and center for most of us. As consumers and investors, inflation erodes our purchasing power and real returns. Consumer price inflation—in general, as well as the key inflation measure known as CPI—represents the upward movement of prices for goods and services. In 2022, inflation exceeded 9% amid a post-pandemic, supply-demand imbalance, with many blaming the Fed and government spending programs for higher prices.

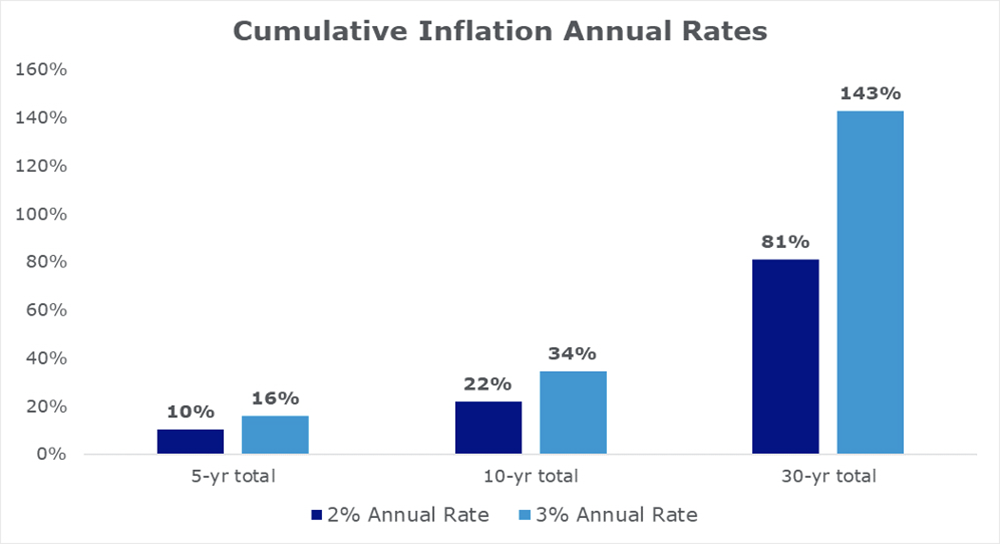

What strikes us is not the monthly year-over-year inflation rate fluctuations that often dominate headlines but the cumulative effect of inflation over time. At the end of March, the CPI had increased 23% over five years since March 2019, a rate not seen since the early 1990s. Looking longer term, even if inflation remains at the Fed’s 2% annual target, prices would rise 81% over 30 years. Should inflation persist at a 3% annual rate, prices would rise by 143% in 30 years.

Source: FRED, Federal Reserve Bank of St. Louis

Source: FRED data and Blue Trust calculations

Although consumer price inflation has been a focal point, that’s not the only inflation that is relevant. Asset price inflation—rising prices for stocks and other assets, sometimes beyond where they should be—also comes into play, and although it’s not part of the usual inflation metrics, it’s critical for long-term investors.

Gold, famous as an inflation hedge, has hit multiple all-time highs in this cycle. Bonds, which typically suffer during inflation, have struggled as an asset class recently, as prices adjusted to one of the hottest stretches of inflation from 2021 to 2023. However, that may change. Bonds now have positive real yields for the first time in years, because yields have surpassed inflation.

So, who or what benefits from inflation? Hard assets, yes. Governments can also benefit from (and cause) inflation because they pay back their obligations in cheaper dollars. Homeowners and real estate investors with low fixed interest rates can benefit from higher prices. Bond issuers and companies also thrive because many have locked in lower interest rates, and revenues often rise with inflation, making companies’ assets more valuable. Combined, these reasons lead us to believe that stocks can also be an excellent inflation hedge.

Investor Implications

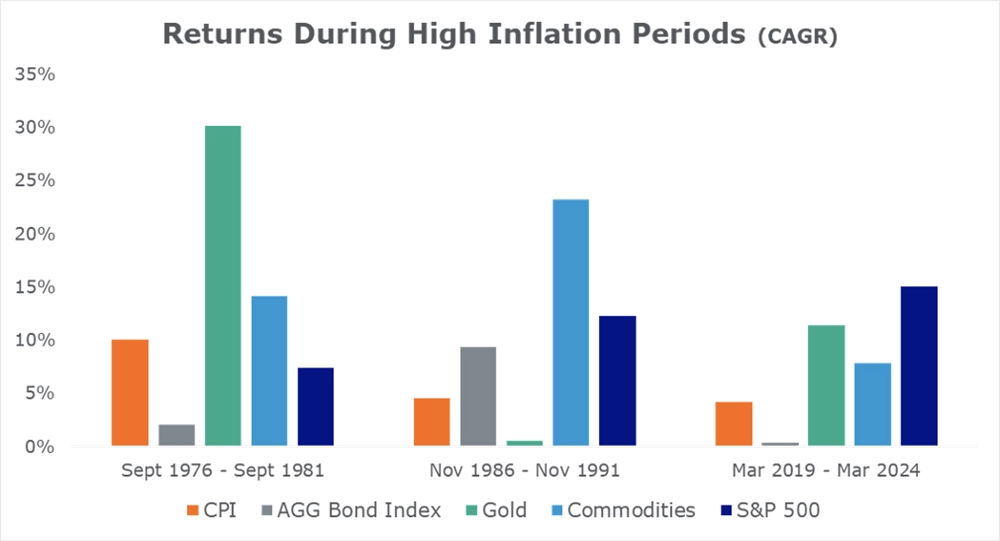

Outpacing inflation is a bedrock of successful long-term investing. With the recent bout of inflation, the question of whether gold should be a bigger slice of an investor’s portfolio is common. While it can be a great tool to keep pace with higher prices, we view it—and other commodity-type hard assets—as best suited for times when inflation is rising or unanticipated. Commodities can be a beneficial diversification tool but, broadly speaking, as smaller pieces of a portfolio’s pie.

We think it’s vitally important to remember the power of equities, and even bonds, in and after inflationary periods. Looking back over the three most recent sustained periods of inflation, we see that gold did very well in the five-year period from 1976 to 1981. However, from 1986 to 1991, it failed to move higher, trailing inflation, diversified bonds, and stocks. In the most recent round of high inflation, gold performed admirably but not as well as stocks.

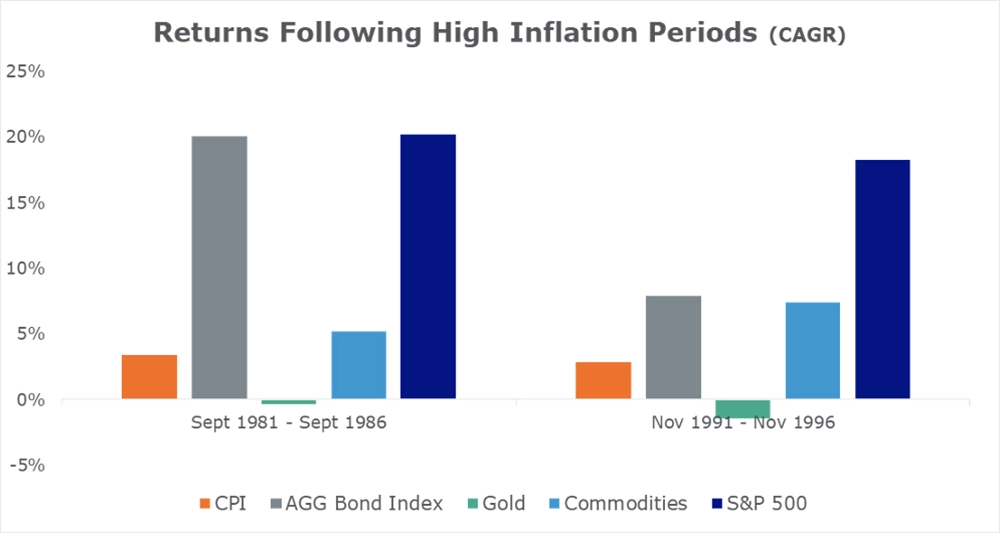

Now, look at the five years after inflation peaks and begins cooling. The picture is much different. In the long run, stocks tend to be the best hedge to protect and grow your wealth. The key, as always, is to invest not just for growth potential but with a well-thought-out plan and disciplined valuation process to avoid overpaying when markets or assets feel frothy, as some do now.

Source: FactSet

Source: FactSet

Conclusion

In Summary, the U.S. stock market has performed well as a result of the extraordinary moves in a few technology-oriented companies, and the economy has fared better than most people expected. Inflation remains stubborn, and it appears that it won’t decelerate as quickly as many—including the Fed—had hoped.

At Blue Trust, all this data adds up to a slightly more cautious outlook as we track early signs that the economy may be shifting. We know that markets are not always rational and both markets and economies are unstable and beset with uncertainty. Those are two of our core investment principles, and they feel especially powerful in today’s environment. We believe that diversification and risk management, especially regarding long-term inflation, are vitally important tools to navigate whatever is to come, and we will continue to monitor, evaluate, and rigorously research all our decisions in order to balance opportunity and risk as we work to help you reach your financial goals.