Transition of Power: A Preview of the New Administration's Agenda

Executive Summary

U.S. equities rallied in the fourth quarter amid optimism surrounding the new administration, capping a yearlong rally fueled by artificial intelligence, a resilient economy, strong corporate earnings, and expectations for lower interest rates. The U.S. market continued to outpace global stocks, which struggled after the U.S. election but managed to post annual gains despite widespread growth concerns in Europe and China.

The Republican sweep drove broadly strong investor sentiment even higher, as investors digested the president-elect’s policy preferences and a host of market-friendly cabinet nominees and proposed leaders. The markets welcomed Trump’s pledges to boost growth, extend and expand tax cuts, and reduce government spending.

While investor optimism broadly reigns as 2025 dawns, much is still unknown as we look ahead, especially as to whether Trump and Congress will be able to follow through on his campaign promises and how they will impact inflation, the U.S. and global economy, and the trajectory of long-term interest rates, which have been on the rise despite central bank cuts to short-term rates.

Blue Trust Insights

Trump Administration Viewed as Market Friendly

In the roughly two months since Election Day, the news cycle has been dominated by Trump’s cabinet nominees. The market has generally welcomed his picks, with Scott Bessent (secretary of the Treasury), Howard Lutnick (secretary of the Department of Commerce), and Paul Atkins (chair of the Securities and Exchange Commission, or SEC) being particularly noteworthy. Atkins, a former SEC commissioner and cryptocurrency advocate, stands in stark contrast to current SEC Chairman Gary Gensler. During his time at the SEC, Atkins emphasized the need for more thorough analysis of the costs and benefits of new SEC rules. Trump’s selections to head the Federal Trade Commission and the Department of Justice’s antitrust division show that both Republicans and Democrats are serious about taking on Big Tech. Although a Republican-led FTC is generally expected to be more friendly to corporations, cases against some of America’s largest tech companies are likely to continue as Trump seeks to enforce competition laws “vigorously and fairly.”

Lutnick, the longtime CEO of Cantor Fitzgerald, is an outspoken supporter of tariffs and would be in charge of promoting American business interests worldwide. He would also have significant influence over trade policy. Trump is seeking to team Lutnick with Jamieson Greer, his pick for U.S. trade representative, to execute his trade agenda. Greer, as chief of staff to the U.S. trade representative from 2017 to 2020, played a key role in imposing tariffs and combating unfair trade practices during the first Trump administration.

Bessent, a longtime hedge fund investor, was a favorite on Wall Street for Treasury secretary thanks to his experience working with prominent figures such as George Soros and Stanley Druckenmiller. Bessent has said that his top priorities will include making good on Trump’s promises to cut taxes and spending. He has expressed his support for tariffs, stating that they can incentivize countries to lower trade barriers with the U.S. In addition to overseeing the sale of U.S. government bonds, he would also serve as a major policy advisor to the president.

Bessent has publicly outlined a “3-3-3 plan” designed to reduce the Federal budget deficit while promoting economic growth and increasing energy production. The plan aims to reduce the deficit to 3% of gross domestic product (GDP) by 2028, accelerate GDP growth to 3% through deregulation and other pro-growth measures, and boost U.S. energy production by the equivalent of 3 million additional barrels of oil per day. He believes that increased oil production will substantially lower oil prices and help drive inflation lower. This may prove difficult as the U.S. is already near record levels of oil production. Bessent has also advocated for extending the 2017 Tax Cuts and Jobs Act and has proposed ways to offset the cost, including freezing nondefense discretionary spending and overhauling parts of the Inflation Reduction Act.

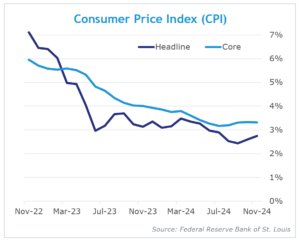

A Resilient Economy Buoyed by Optimism

The economy Trump is inheriting appears strong, and a recession seems unlikely. We have seen solid GDP growth and moderating inflation, though the latter remains somewhat stubborn. While tariffs alone would likely have minimal impact on inflation, the combination of tariffs, tax cuts, and deregulation could potentially push inflation higher than the market expects. The last mile of reducing inflation has been difficult, and the core rate of inflation (excluding food and energy) has been trending sideways for seven months. This may, in turn, prompt the Fed to take a more cautious approach to rate cuts. Indeed, the median forecast of Fed policymakers released in December suggests just 50 basis points of easing in 2025, down from 100 basis points in September. Deregulation could unlock growth, as Trump has vowed to cut 10 regulations for every new one imposed. Tax cuts and regulatory clarity may instill confidence in corporations, leading to a more attractive environment for investment and merger-and-acquisition activity.

In the third quarter last year, we pointed out how government job growth had outpaced the private sector, something typically seen before recessions. Health care and government jobs have accounted for more than 60% of this year’s payroll gains; however, it’s important to note that government employment, as a share of payrolls, is below its pre-pandemic average. This likely suggests that government employment is undergoing a slower normalization process in the post-pandemic era. Additionally, we’ve seen strength in the cyclical construction and transportation sectors, although manufacturing has remained sluggish. Employment reports continue to show job gains, although the average monthly gain has slipped below the 2010-2019 average. Steady wage gains have continued to fuel a strong consumer and supported the economy.

A Bold Cost-Cutting & Efficiency-Boosting Strategy

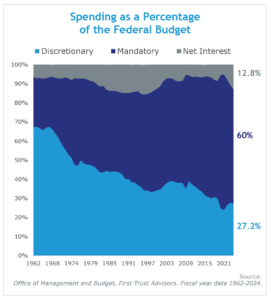

One of the incoming administration’s ambitious goals is to increase government efficiency through significant cost cutting. The Department of Government Efficiency (DOGE) was assembled to accomplish this goal and is pursuing three key reforms: regulatory rescissions, administrative reductions, and cost savings. DOGE will be co-headed by Tesla CEO Elon Musk and entrepreneur Vivek Ramaswamy. The heads of DOGE have stated that they will present a list of regulations to the president, who can immediately pause their enforcement through executive action, thereby initiating the review and potential rescission process. DOGE also expects to right-size government agencies by identifying “the minimum number of employees” necessary for agencies to perform core functions.

Most government spending is mandatory, leaving little room for DOGE to trim excess costs. About 27% of the federal budget is considered discretionary, and that drops to 15% when excluding defense spending. Using the 2023 federal budget as an example, total discretionary spending amounted to $1.7 trillion. Without reforms to mandatory spending, it will likely be difficult to achieve the multi-trillion-dollar cost-cutting goal that has been floated by DOGE leaders, at least in the short term. Pushback should be expected, as members of Congress will seek to protect spending that benefits their constituents.

History offers some insight into the potential success of a government efficiency task force, with a similar team convened under Ronald Reagan. Established in 1982, the Grace Commission set out to eliminate waste and inefficiency in the federal government. Nearly 2,500 recommendations were made to reduce the deficit by more than $400 billion over three years; however, while some minor reforms took place, most of the commission’s proposals were not enacted.

Attempts at meaningful mandatory spending reform will require an act of Congress and are likely to face significant resistance. Even if major cost savings are not realized, cutting red tape could accelerate growth, generating more revenue and reducing the deficit without touching entitlements. Given politicians’ resistance to cut spending, increasing growth and productivity appear to be the best options to overcome rising debt levels. We are hopeful that DOGE can spur such activity.

Looking Ahead

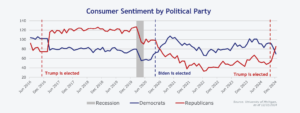

Despite a stable economic environment, partisanship was clearly evident in a post-election survey of consumer sentiment. In early December, the University of Michigan’s Consumer Sentiment Index climbed to a seven-month high, led in the wake of the election by a sharp upswing in the expectations of Republicans, which outweighed a contrasting dip in the mood of Democrats. Historically, it’s clear that respondents tend to change their opinion based on which party is in power and which party they favor.

Contrary to the survey respondents’ sentiment about the economy, we would advise against making market decisions based simply on who controls the White House. We also would caution against making investment decisions based solely on policy speculation that may or may not materialize. As we discussed in a 2024 blog post, the market tends to trend upward over the long term, with similar returns under Democratic and Republican leadership. As we saw in Trump’s first term, stocks performed well despite multiple rounds of tariffs. However, it’s worth pointing out that Chinese equities outperformed U.S. equities during Trump’s presidency, surpassing the U.S. by 27% (4.1% annually) on a total return basis. However, the U.S. did outperform starting from the first announcement of tariffs in March 2018. While we fully expect Trump to enact tariffs and continue using tough rhetoric, the results may not be as dramatic as some may think. We expect that the administration is keenly aware of the different economic environment this time around. With inflation likely a decisive factor in sending Trump back to the White House, and with some countries publicly stating their intentions to enact retaliatory tariffs, we think the administration will seek a more prudent strategy of negotiation whenever possible.

With four years of governing experience and a better understanding of how Washington operates, Trump should be more effective at getting things done in a second term. With just two years until midterm elections, we expect the administration to move swiftly on major policy goals. We enter 2025 with a reminder: Successful investing requires a long-term perspective and a balanced philosophy centered on reaching your goals.

Economic and Investment Review

Markets Continue to Rally as Risk-On Sentiment Drives Stocks Higher

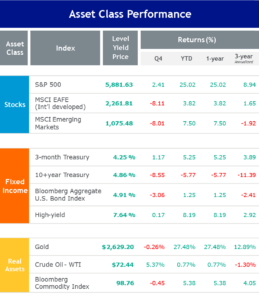

The S&P 500 Index recorded its sixth consecutive quarterly gain to close out 2024, rallying in the wake of Donald Trump’s victory and a Republican sweep of both houses of Congress. Global equity indexes, meanwhile, pulled back amid concerns about Trump’s tariff plans and their potential impact on global trade. U.S. data around growth, jobs, and inflation broadly continued to signal economic resilience, driving market expectations for a slower, shallower rate-cutting cycle from the U.S. Federal Reserve (Fed). The U.S. market sharply outperformed its developed and emerging market peers, which broadly declined during the quarter. While we acknowledge that the U.S. is home to the most innovative and dynamic economy in the world, our main concern is valuations. More than half of the outperformance of U.S. markets in recent years can be attributed to valuation expansion. Profit margins are also historically elevated, and the dollar appears overvalued, which is why we continue to recommend a diversified allocation that includes international equities.

U.S. stocks climbed fairly steadily throughout 2024, with only occasional periods of elevated volatility, centered around worries about the Fed’s path forward (as in April) or brief surges in recessionary fears (as in midsummer). For the most part, investors shrugged off those concerns as enthusiasm around artificial intelligence, continuing robust corporate earnings, and economic resilience drove the S&P 500 and many other indexes to a series of all-time highs. Gains were heavily concentrated, as the so-called Magnificent Seven and some other AI-driven, large-cap, technology-related stocks and sectors drove much of the market’s gains. In the third quarter, multiple long-running market themes reversed, as the U.S. market trailed its emerging and developed market counterparts while cyclical sectors, value stocks, and smaller caps posted the strongest returns. Across the year, however, the U.S. was dominant, led by the communication services, information technology, and consumer discretionary sectors, along with large-caps and growth equities.

U.S. and global bond markets were essentially flat across the first half of the year, as anticipated interest rate cuts either came later than expected (the European Central Bank made its first in June) or remained anticipated (U.S.). Fixed income indexes generated most of their 2024 returns in the third quarter, amid optimism for a Fed cut, which arrived in September and was larger than many expected.

Commodities markets saw periods of heavy volatility and widely mixed returns across sectors in 2024, with key indexes falling modestly in the fourth quarter and finishing the year slightly higher. Concerns surrounding China’s economy and global growth held the broad asset class in check but helped fuel gold prices to a steady stream of all-time highs. Optimism around rate cuts, safe-haven demand, and geopolitical risks drove gold higher before the precious metal pulled back in the final two months of the year. Oil prices rose modestly in the fourth quarter but finished the year essentially flat. Crude advanced nearly 14% in the first half, reaching near $87 per barrel in April, amid supply concerns and heightened geopolitical conflicts. In the second half, crude dipped to a three-year low in September, weighed down by widening supply-demand imbalances amid rising spare capacity, concerns about China, and some signs of weakening demand in the U.S.

Source: FactSet, 3-month Treasury – ICE BofA U.S. Treasury Bill (3 M), 10+ year

Treasury – ICE BofA U.S. Treasury (10+ Y), U.S. Aggregate – Bloomberg U.S.

Aggregate, High Yield – Bloomberg U.S. High Yield – Corporate, Gold – NYMEX Near

Term, Crude Oil – NYMEX Spot