What Trump’s Win Means for the Economy and Markets

In a surprisingly decisive victory, Trump has reclaimed the White House. Republicans also clinched the Senate and will likely retain their majority in the House. If they complete the sweep, Trump will face little resistance to enacting his ambitious agenda.

This morning’s market reaction already reflects the likely implications of his policy priorities:

Deregulation

Throughout his campaign, Trump railed on burdensome and costly regulations, committing to eliminate 10 rules for every new one and tap Elon Musk to lead a new government efficiency initiative.

Higher Tariffs

“Tariff” is Trump’s favorite word. He favors huge new tariffs, especially on China.

Lower Taxes

In his first term, Trump’s landmark legislation was the Tax Cuts and Jobs Act, which delivered major tax benefits to businesses and individuals. This term, Trump intends to extend and expand tax cuts.

Bottom line: Trump’s primary policies are likely to spur faster economic growth but also higher inflation and deficits, and markets have reacted accordingly.

You can even see the implications of Trump’s policies reflected within markets. For example, in the U.S., the financial sector, which will likely benefit the most from deregulation, is up the most. Meanwhile, the real estate sector, which is highly interest rate sensitive, is performing the worst.

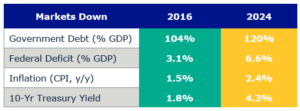

While the market’s moves are rational, current conditions could restrain the extent to which Trump can raise tariffs and lower taxes. Compared with 2016, government debt, deficits, inflation, and interest rates are significantly higher (see table below). Major tax cuts and tariff hikes would likely exacerbate inflation, something that the government, electorate, and markets would find undesirable.

Source: 10y Yield (FRED, as of Oct 31), Deficit (OMB, as of Sep 30), Debt (FRED, as of Jun 30), Inflation (FRED, as of Sep 30).

There’s still much that’s unknown, from the final count in the House to factors exogenous to politics. In the months ahead, we will be watching to gain clarity on the extent to which Trump and Congress intend to act upon his campaign promises and will adjust portfolios as necessary.

If you have specific questions about your portfolio, please contact your advisor. If you do not have a Blue Trust financial advisor and are interested in speaking to one, please email info@bluetrust.com or call 800.987.2987.

CAS00000834-11-24