What is the Value of Five Golden Rings?

In the beloved Christmas carol, “The 12 Days of Christmas,” the true love gave five golden rings on the fifth day of Christmas. Ever wonder about the value of five golden rings? As an investment, and one that attracts significant attention during inflationary times and global crises, the price of gold recently reached a new high following the Israel/Hamas conflict and the expectations that the Federal Reserve may lower interest rates in 2024, potentially loosening monetary policy.

People have used gold as a medium of exchange for thousands of years. They have molded it into jewelry, saved it as a portion of investment portfolios, and used it in electronics and other applications. The crypto-currency industry has even borrowed the term “mining” to describe the creation of additional units. Gold is a unique commodity because people do not consume it like energy or grains. Almost all of the gold produced throughout history still exists. But, as investors, how should we view this inert metal relative to other asset classes?

Gold Background

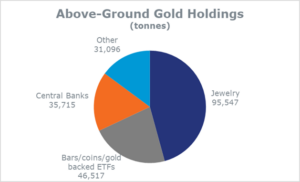

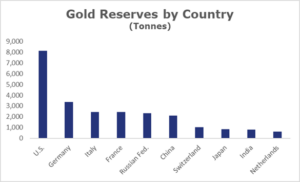

How is gold used around the world? Not surprisingly, jewelry is the most common use of gold, with about 46% of all gold in jewelry. China recently overtook India as the largest buyer of gold jewelry; together they account for nearly half of global demand for gold jewelry. Coins, bars, and gold-backed, exchange-traded funds (ETFs) are the second largest use of gold, with roughly 22% of the total usage. Central banks, collectively, hold about 17% of all existing gold The U.S. is by far the predominant holder of gold reserves. The remainder, about 15%, is used in industrial applications and electronics.

So, for investors, the demand for gold and the price of gold are influenced by factors beyond what investment participants contribute. The supply of gold available for investment can increase because jewelry and electronics containing gold can be melted down and refabricated into investment-oriented products such as coins and bars.

Source: World Gold Council

Source: World Gold Council

In addition to existing gold holdings, gold mining continues to add supply to the market. The uses of new gold tend to match that of current applications, with jewelry being the highest demand and investment products second. As the price of gold price rose in 2019 and 2020, investment demand for it increased. Subsequently, production responded to those higher prices.

Investing in Gold

Investors may have multiple reasons to own gold. Many cite inflation protection, uncertainty, and even concerns over currency values. The physical nature of gold can be beneficial during those periods. Inflation, a general rise in prices, influences the value of gold. As an asset, the price of gold can rise along with other prices. Plus, producers of gold experience higher production costs during inflationary periods, which may influence prices and/or supply.

However, there are some downsides to owning gold, too. While investors can gain exposure to gold through physical purchases, such as coins and bars, or through ETFs or futures contracts, these methods eventually allow exposure to a metal that does not generate any cash flow and may cost money to store, insure, and maintain.

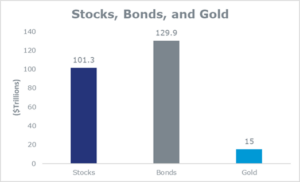

Our investment models at Blue Trust incorporate gold, but it must compete with other assets that generate income and interest, mainly stocks and bonds. From a market-value perspective, gold pales in comparison to stocks and bonds (see chart below). The value of gold is all holdings: jewelry, investment, central bank, etc., and with the interest rates on U.S. government securities near 5%, today the bar is set even higher for gold.

Source: SIFMA and World Gold Council. As of 2023.

The competition between gold and stocks is critical because the source of their value is different. Gold production includes mining, smelting, and fabricating the metal. Each of these steps involves some level of productivity and adds value to the final product. Blue Trust’s Principle of Human Productivity recognizes the importance of these steps. However, the end product of this work, gold, is not productive in and of itself but it does have value. When compared with stocks, the combination of human productivity and natural resources generates an asset (company) that is a productive asset. A company’s profits are recycled back into the company to increase performance even further, and the cycle continues. This compounding effect can generate significant wealth. As illustrated in the chart below, stocks, by far, have generated the most wealth through numerous wars and crises.

Indices used: Stocks – 2005-Present: S&P 500, previous information: Ibbotson Associates, Stocks, Bonds, Bills, and Inflation 2005 Yearbook; Gold – 1978-Present: S&P GSCI Gold Index, prior to 1978: Bloomberg Gold Spot Price; Bonds – 2005-Present: Bloomberg Aggregate Bond Index, prior to 2005: Ibbotson’s intermediate-government bonds: Ibbotson Associates, Stocks, Bonds, Bills, and Inflation 2005 Yearbook. Chart based on monthly total returns.

While gold has characteristics that may make it attractive as an investment, it also has limitations and high costs. The biggest hurdle may be the competition from the income and interest generated by stocks and bonds. That said, having exposure to gold may be appropriate depending on an investor’s time frame and how competing assets, stocks, and bonds are valued and positioned for growth.

If you would like to learn more about Blue Trust’s exposure to gold or our investment offerings, please contact your advisor.

As with any investment strategy, there is potential for profit as well as the possibility of loss. Blue Trust does not guarantee any minimum level of investment performance or the success of any investment strategy. All investments involve risk and investment recommendations will not always be profitable. Diversification does not guarantee investment returns and does not eliminate loss. Past performance does not guarantee future results.