Should Investors Still Hold Bonds?

Bonds are having an almost unprecedented year. Through April 30, the Bloomberg U.S. Aggregate Bond Index declined 9.5%, its worst four-month drawdown dating back to 1975. Investors are not accustomed to this level of volatility in bonds and for good reason. We must go back to 1980 to find a drawdown—of any length—that exceeded 9.5%.

To make matters worse, stocks have also suffered steep losses this year. Investors often hold bonds to help protect against stock market selloffs. That conventional wisdom is currently experiencing a trial by fire. In this market update, we describe what has caused bond losses, what the future may hold, and our view of whether bonds still make sense for portfolios.

What Has Caused Bond Losses?

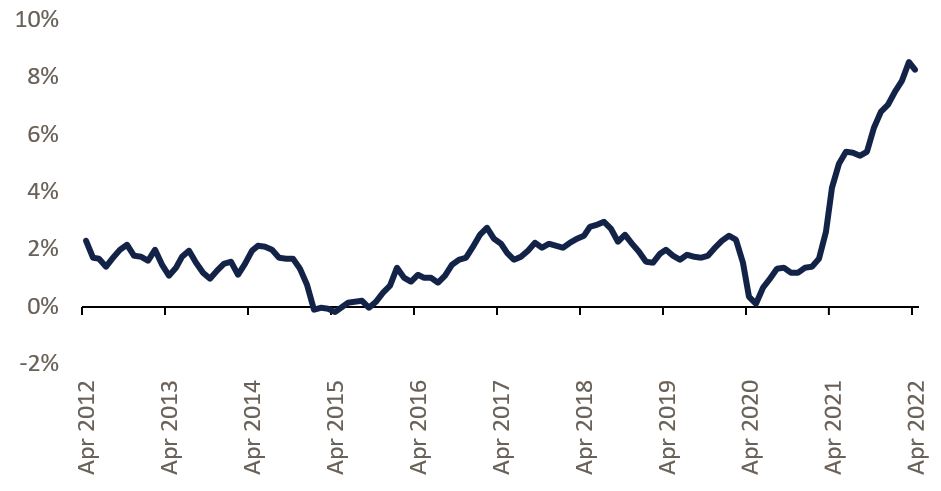

Currently, high inflation and the Federal Reserve (Fed)’s plan to combat inflation, primarily through interest rate hikes, is weighing on bonds and stocks. Inflation has surged much higher than expected over the past year. One year ago, consumer price inflation (as measured by year-over-year CPI) was 4.2%. Now, it’s 8.3%.[1] The rapid rise in the price of goods and services has mainly resulted from COVID-induced swings in both demand and supply, stimulus-fueled increases in demand, and disruptions in supply due to the Russia-Ukraine war. Energy transition policies and supply chain infrastructure have complicated the situation further.

U.S. Inflation

(year-over-year CPI)

Source: FRED

High inflation is problematic for the economy via many channels, including its negative impact on consumer sentiment, real wages and spending, purchasing power of savings, and business expenses. Over the last five months, the Fed has increasingly recognized the need to contain inflation and is now signaling its intention to quickly remove accommodative monetary policy—primarily by raising the Fed funds rate. Expected rate hikes have, in turn, pushed bond yields up (and bond prices down). The bond market is forward-looking, so although the Fed has only begun to raise rates, bond yields have moved much higher and already reflect a series of steady rate hikes. In that vein, the selloff this year has been very orderly and valuation-driven. In other words, the increase in interest rates can explain the negative returns in bonds and stocks. There are no signs of liquidity stress, credit deterioration, or panic-selling driving the markets, which is a good sign, so far.

Fed Hikes are Already Reflected in Bond Prices

Source: CME FedWatch (as of 5/9/22)

What Could Happen Next?

Looking ahead, there are three broad possibilities. First, inflation could remain stubbornly high if the Russia-Ukraine war escalates or COVID lockdowns in China worsen. These scenarios would likely result in continued pressure on bond prices as expectations for further rate hikes would presumably rise. However, it is unclear how restrictive the Fed may become since it can’t affect supply-driven inflation and has a dual mandate to promote stable prices and maximum employment.

Another possibility is that inflation gradually moderates. This scenario seems most probable based on increasing year-ago price comparisons, moderating commodity prices, and declining inflation-adjusted wages. Low consumer sentiment, declines in financial market wealth, removal of fiscal stimulus, and higher interest rates play a role as well. Higher interest rates reduce consumer demand for debt-financed assets (such as houses and cars) and lower business spending. If inflation does indeed moderate as the Fed and market participants expect, bonds will likely stabilize and benefit from their higher current yields.

The final possible scenario is that the economy tips into a recession. Some economists and investors are concerned that the combination of high inflation and rising interest rates could depress economic growth enough to tip the U.S. into a recession. While possible, this is not the most likely scenario as consumers still have high levels of savings and abundant job opportunities while corporations are still generating high earnings and are not overly indebted. Also, interest rates are not near restrictive levels yet, despite moving higher. If a recession does occur, however, it will likely be mild as there aren’t any major debt or asset bubbles to deflate. Regardless, bonds would probably do well in this scenario since interest rates usually decline in recessions.

What Should Investors Do?

Investors who are concerned about their bond investments should take into account the following considerations. First, they need to ensure that any cash withdrawals needed over the next year or two are in very short-term investments so those funds are not subjected to undue credit and interest rate risks. Second, investors might consider diversifying into other investment types, including TIPS (Treasury Inflation-Protected Securities), absolute return strategies, gold, commodities, and private credit, to protect against the wide-ranging risks that the current environment poses. Third, for intermediate-term investments (around five years out) we would recommend that investors patiently stay the course. As bond prices have decreased, yields have risen. This swing bodes well for future bond returns, and our portfolios are specifically designed so that clients have the opportunity to recover short-term losses caused by rising rates before they need their money back. This goal is accomplished by matching the duration of the portfolio to when the client needs the funds so that the portfolio has time to make up losses by the extra yield generated from higher interest rates.

Predicting the future is impossible. At Blue Trust we believe it’s best to start by matching the time horizon of your investments with the time horizon of when you need your withdrawals. Additionally, instead of trying to position portfolios for a single scenario, we believe it’s best to prepare for a range of potential outcomes. We accomplish this by diversifying into investments that increase in value as inflation rises and by constantly monitoring valuations to identify opportunities and risks as they develop. We believe that this investment approach will better withstand the impact of many economic environments and is the most prudent path forward for investors who want to meet time-based goals.

[1] As of 4/30/2022.

15023980-05-22