“Wisdom for Wealth. For Life.” Episode 14: Recent Economic Data and Market Numbers are not What Investors Hoped for… How Do We Process and Prepare?

Blue Trust’s CEO and chief investment officer, Nick Stonestreet, along with head of investments, Brian McClard, recently shared some insights on the current economic landscape, why the market is struggling, how international events are affecting investors, and what may lie ahead. You can view their full discussion in the most recent episode of our “Wisdom for Wealth. For life.” podcast.

Episode 14: Recent Economic Data and Market Numbers are not What Investors Hoped for… How Do We Process and Prepare?

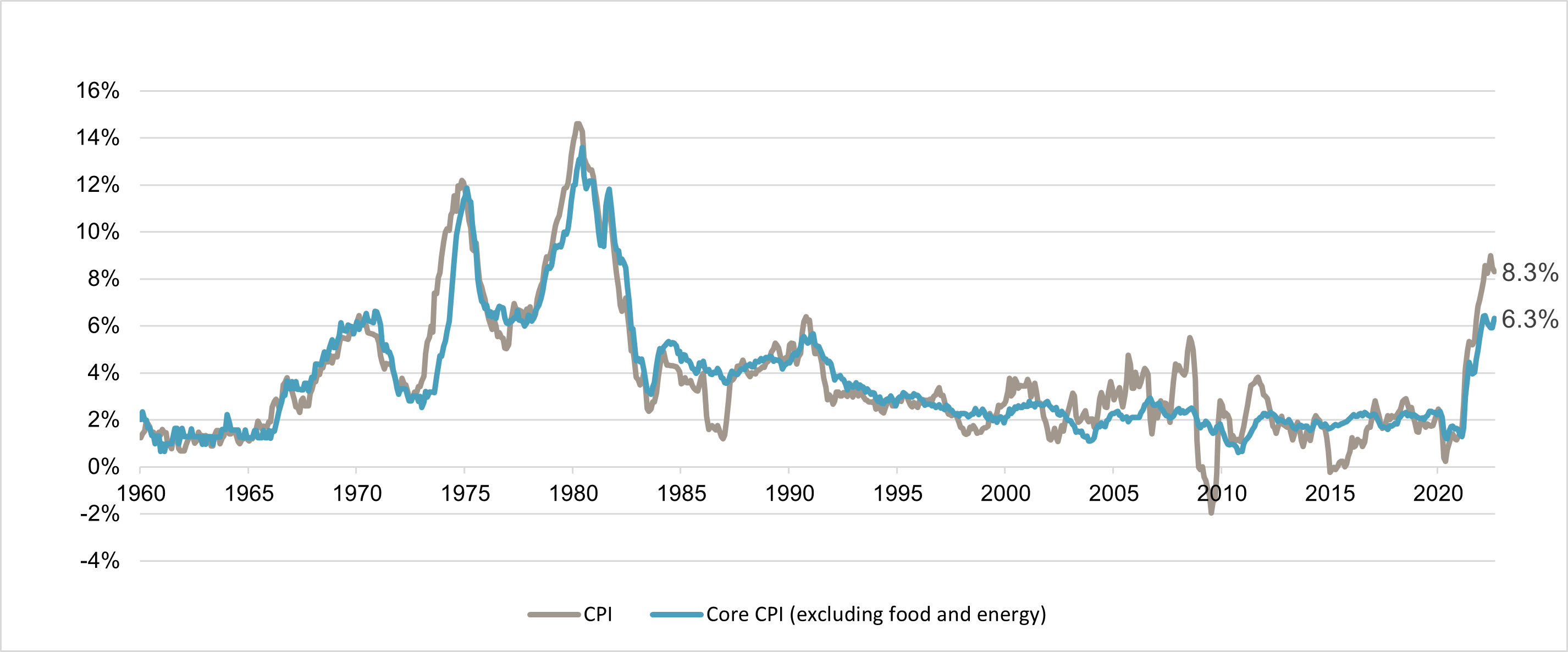

On September 13, the Bureau of Labor Statistics released the August Consumer Price Index (CPI) report, which measures the change in price for a wide variety of goods and services and is used to measure inflation. Unfortunately, CPI came in higher than anticipated at 8.3%, which was lower than July’s 8.5% print, but higher than the projected 8.1%. On a month-over-month basis, CPI increased 0.1% versus expectations that it would fall 0.1%. What was more disappointing, however, was the CPI core rate, which does not include the more volatile food and energy categories, rose 0.6% month-over-month in August and 6.3% year-over-year versus the anticipated 0.3% and 5.9%, respectively.

Year-Over-Year Percentage Change in Consumer Price Index

Source: Bureau of Labor Statistics

Along with more aggressive interest rate hike expectations, this unwelcome surprise in CPI immediately injected fear and pessimism into the market, as evidenced by sell-offs in stocks and bonds. Let’s take a deeper look at the CPI report and September’s Federal Open Market Committee (FOMC) meeting and their effects on interest rates and markets.

August’s consumer price index report

The most positive signs in the August CPI report were the price of gas, which fell -10.6% compared to the average price in July, and energy as a whole was down -5.0% compared to last month. Given that gas prices are the one expense that Americans typically see on a daily basis, lower costs at the pump had likely contributed to favorable inflation expectations going into the August CPI report. However, lower gas prices were offset by higher costs in shelter and healthcare, which increased 0.7% and 0.8% respectively on a monthly basis and were a primary contributor to the larger-than-expected core CPI increase.

The rise in core CPI is alarming because prices in this category are traditionally more stable and tougher to reduce than food and energy prices. For example, housing is especially difficult to disrupt and is a major spending category for consumers, so the market is bracing for higher prices and inflation.

Federal Reserve’s response

As inflation rose over the past two years, the Federal Reserve (Fed) started increasing the Fed Funds Rate. As this rate rises, the cost of borrowing increases and liquidity is pulled out of the economy, which helps drive inflation down. The Fed Funds Rate had been at 0% since March 2020, but year-to-date through August, the Fed had raised interest rates four times for a total increase of 2.25%. The Fed is watching CPI closely, hoping to see it steadily decrease. However, after the August CPI report, the Fed was almost guaranteed to announce another 0.75% rate hike at the September 21 FOMC meeting, and an additional 0.75% rate increase has become the expectation for the upcoming FOMC meeting in November. Collectively, these increased rate hike expectations result in an anticipated Fed Funds Rate of 4.5% by Q1 2023, which is about 0.5% higher than expectations before the August CPI report.

On September 21, the Fed did indeed announce a 0.75% interest rate hike, increasing the Fed Funds Rate to a range of 3.0% – 3.25%, its highest since 2008. Fed chairman, Jerome Powell, spoke after the September 21 announcement and echoed comments from his Jackson Hole speech reiterating that the Fed is committed to bringing inflation down and while a recession is not the goal, we should expect economic contraction and some consumer discomfort before we see inflation receding to the target rate of 2%.

Market response

Bonds have inverse relationships with interest rates, so while current and future interest rate increases were priced in after the CPI report on September 13, the Bloomberg Agg fell -1.9% by September 23. The decrease in bond prices sent yields higher. Markets were quick to react during Powell’s press conference, with U.S. 10-year Treasury notes hitting 3.51% and two-year Treasury notes, which are more sensitive to short-term interest rate expectations, rose to 3.99%.

Stocks are affected by interest rates as well. Following the CPI report, the Dow Jones Industrial Average dropped nearly 1,300 points or 3.9%, the S&P 500 fell 4.3%, and the Nasdaq Composite slid 5.2%. Following the FOMC meeting, the S&P and Dow Jones declined an additional 1.7%, and the Nasdaq fell 1.8%. Higher interest rates and restrictive monetary policy by the Fed could result in a recession, so investors appeared to take some risk off the table by selling stocks.

How will this affect me?

Increases in the Fed Funds Rate don’t result in immediate or proportional increases in all rates, but they will lead to further increases in interest rates. We will experience the immediate impacts through an increase in consumer lending rates, such as rates charged by credit card companies, auto loans, and mortgage rates.

We will almost certainly see more volatility in stocks and bonds as the Fed battles inflation. Taming inflation without triggering a recession is possible but extremely challenging; so further drawdowns in stocks and bonds are likely as the economy digests these new higher interest rates.

What can I do to prepare?

Rising interest rates are not all bad for financial markets. With higher interest rates comes higher yields, not only in bonds but also in cash or money market accounts. Despite a historic drawdown in bonds, we still recommend holding bonds in your portfolio because with these higher yields, you may not have to take as much risk in the stock market to accomplish your short- and intermediate-term goals. However, we also still believe that holding stocks in your longer-term portfolio is prudent because stocks have a higher probability of outperforming inflation over longer time periods.

Our investment strategy group is evaluating the current environment and will look for opportunities to maximize the probability of success of our portfolios achieving their time-based goals. Last quarter we lowered credit and equity risk by investing more in treasuries and higher-quality stocks. We will look for similar opportunities this quarter.

We also recommend that you revisit your financial plan with your financial advisor if you have not done so recently. It is wise to document your short-, intermediate-, and long-term financial goals and make sure you are investing accordingly. Particularly with the Fed suggesting lower expected economic growth and corresponding turbulence, it is prudent to look at your cash flow needs over the next couple of years.

Partnering with a financial advisor who walks beside you with a time-based strategy can help you navigate times of uncertainty like these. If you would like to discuss having a diversified strategy in place for your investments, please contact us at 800.987.2987 or email blog@bluetrust.com.

In our “Wisdom for Wealth. For Life.” podcast series, we share financial advice and wisdom from our network of wealth advisors and thought leaders in the industry, and from around our community of over 10,000 financially blessed families who apply biblical wisdom to their financial planning and giving.

The podcast is available across most major podcast networks. If you enjoy this episode, please consider writing a review and sharing with friends and family wherever you listen to podcasts:

Thank you and we hope you will enjoy this exclusive content!