Labor Pains: The “Sahm” Before the Storm?

On July 31, Jay Powell, Chair of the Federal Reserve (Fed), characterized the labor market as gradually normalizing. Over the following two days, labor market data came in weaker than expected, causing fear that perhaps the labor market is deteriorating and the Fed is waiting too long to cut rates.

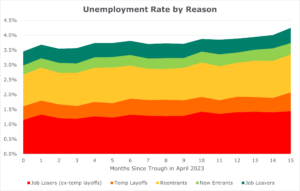

The labor market isn’t the only important economic indicator, but since it has received outsized attention lately, let’s examine its current state, starting with the unemployment rate (see chart below). As Chair Powell said last week, this metric is probably the best single indicator of labor market health. While the unemployment level is still low, it has meaningfully increased from its trough of 3.4% in April 2023. If the rate were to level out from here, the economy would likely fare fine. However, there is a risk that the recent increase could cause a self-reinforcing spiral as more unemployed persons lead to lower spending, less business activity, and, thus, more unemployment.

Source: FactSet, as of July 2024.

The historical observation that a large and fast enough increase in unemployment tends to perpetuate itself underpins the Sahm rule, which has been a reliable recession indicator and was triggered by last Friday’s employment report. [1] While it shouldn’t be ignored, Claudia Sahm, the economist who created the Sahm rule, has expressed that this time might be different. Why? One major reason is increased labor supply, from high immigration and labor market participation. The unemployment rate includes all individuals who are searching for a job, regardless of the reason. It could be someone seeking their first job, rejoining the workforce, or looking to replace a job they lost. If new job seekers are driving the unemployment rate higher, as opposed to those who have lost their jobs, the recent data would be less concerning. But is that what is currently happening?

The chart below depicts the unemployment rate based on the reasons given by unemployed persons. The reasons are color-coded to indicate which are most/least concerning, with red showing the most concerning category.

Source: FRED, As of July 2024.

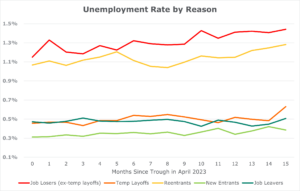

To help decipher what is driving the increase in unemployment, the graph below charts each reason as an independent rate. While it’s clear that new entrants (e.g., college graduates & immigrants) and reentrants (e.g., those coming out of retirement or a career break) to the labor force have contributed to the rise in unemployment, job losers (including those temporarily laid off) have also.

Source: FRED, As of July 2024

While the official unemployment rate in the U.S. is known as U-3, the narrower U-2 rate only includes people who have lost jobs, and it’s also trending higher. So, while an increase in the labor supply is partially to blame for rising unemployment, labor demand is clearly weakening.

Source: FactSet, As of July 2024

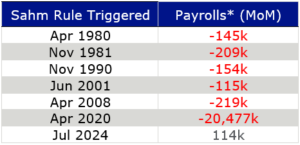

Now, let’s turn from unemployment to job creation. The good news is that more jobs are being created now than in previous times when the Sahm rule was triggered. Since 1980, there have been six recessions. Rising unemployment activated the Sahm rule during each of those, with no false signals. However, in each of those instances, businesses were already reducing jobs. Today, businesses are still adding employees.

Source: FRED. *Payrolls: This measure of jobs accounts for approximately 80% of U.S. workers.

However, job gains are slowing and have been increasingly concentrated in the healthcare and government sectors, which tend to be less sensitive to the business cycle. In fact, the diffusion index, which measures the percentage of private industries adding jobs over the last month, just fell below 50% for the first time since COVID, indicating that the breadth of job creation has narrowed.

Source: Bureau of Labor Statistics (BLS), as of July 2024. Below 50 is commonly considered a recession signal.

These signs indicate the labor market is waning and should be monitored closely; however, we still believe broader economic conditions are more consistent with an economy that is moderating, not on the brink of a recession. Reasons for this optimism include the strong balance sheets of consumers, local governments, and corporations; solid consumer spending and corporate earnings growth; and the Fed’s ability to lower rates dramatically, which could reduce debt burdens, spur credit creation, and boost the housing market.

It is important to remember that drawdowns like we experienced earlier this week are normal. Even when the economy is healthy, intra-year market corrections are common. Given high valuations, it’s unsurprising that the market sold off in reaction to cracks that emerged in the labor market. While the abruptness of the selloff caused some panic that we might be entering a pronounced drawdown, we are not overly concerned that we are facing a sharp decline because we view an economic contraction as unlikely.

At this time, we do not believe portfolio changes are warranted. However, if a sharp selloff continues from here, without further economic evidence, the market would likely be getting ahead of itself and could present an opportunity.

We know heightened volatility and uncertainty are uncomfortable. Know that our investment team is closely monitoring incoming economic data. They are watching for further indications of economic weakness and will make any necessary adjustments, if warranted. If you have specific questions about your portfolio, please contact your advisor.

For more insights and real-time reflections, follow Brian McClard, Chief Investment Officer, on X (formerly Twitter).

[1] The Sahm rule or Sahm Recession Indicator signals the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to the minimum of the three-month averages from the previous 12 months. https://fred.stlouisfed.org/series/SAHMREALTIME

CAS00000478-08-24