Is Value Investing Dead?

May 31, 2019

You can ask just about anyone how to make money in the stock market and they’ll probably tell you, “buy low, sell high.” In fact, this phrase has become so commonplace, it almost seems overused. Yet, to be a successful investor, you must follow this one simple strategy.

Unfortunately, putting this strategy into action isn’t so simple. How do you really know if you’re buying a stock at a “low” price? You need a point of comparison. This is the notion that underpins value investing.

Although value investing has earned some of the most successful investors throughout history a lot of money, the last decade has been difficult for anyone following this investment approach. The recent stretch of underperformance versus other styles of investing—namely, growth—has many people wondering if value investing is dead.

We don’t think the glory days of value investing are behind us, and we’ll make our case why throughout the remainder of this article. First, we’ll review what it means to be a value investor.

What is Value Investing?

Imagine you’ve been eyeing a new pair of sunglasses, but the price tag has kept you from making the purchase. You know they’re worth $150, but you’d rather pay less. So, you wait until they go on sale and buy them at the bargain price of $75.

The next day, a well-known celebrity is photographed wearing the same sunglasses. They immediately sell out in stores. You recognize the opportunity to make some extra money and sell your newly purchased pair for $200, earning a profit of $125–$75 more than if you had bought the glasses at the original retail price. Congratulations, you’re a value investor!

Value investing involves buying a company’s stock when it appears underpriced relative to the company’s underlying value and selling when the stock price more accurately reflects this value. In general, value investors believe that market participants overreact to good and bad news, which presents opportunities to capitalize on temporary price dislocations.

Approaches to Value Investing

Margin of Safety. Pioneered by professors Benjamin Graham and David Dodd of Columbia Business School in the 1930s and popularized by Warren Buffet, a margin of safety approach involves thoroughly analyzing a company’s fundamental attributes through a variety of research methods—for example, financial statement analysis, interviews with company management, or “boots on the ground” company visits—and assigning the company an intrinsic value based on the results. This value is then used to determine the “margin of safety,” the difference between the company’s intrinsic value and the market value of its stock price.

The margin of safety principle is widely used to reduce downside risk when investing. However, it doesn’t guarantee a profitable investment, since fundamental analysis can be very subjective.

Factor Investing. In 1992, professors Eugene Fama and Kenneth French of the University of Chicago published their ground-breaking three-factor model, which identified value as one of three primary factors that explains a stock’s return over time. Their work largely led to the birth of factor investing—an approach that uses quantitative methods to identify and target the factors that contribute to a stock’s return—and a new generation of value investors.

Value in the Current Environment

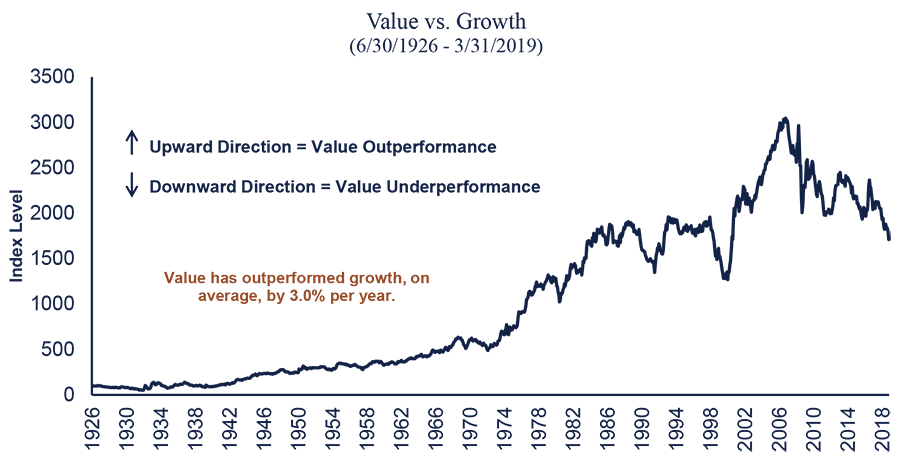

The long-term data in support of value investing is compelling. Indeed, from 1926-2019, U.S. value stocks have outperformed growth stocks by 3% per year, on average.

Source: Fama/French returns for portfolios formed on book-to-market (value-weighted).

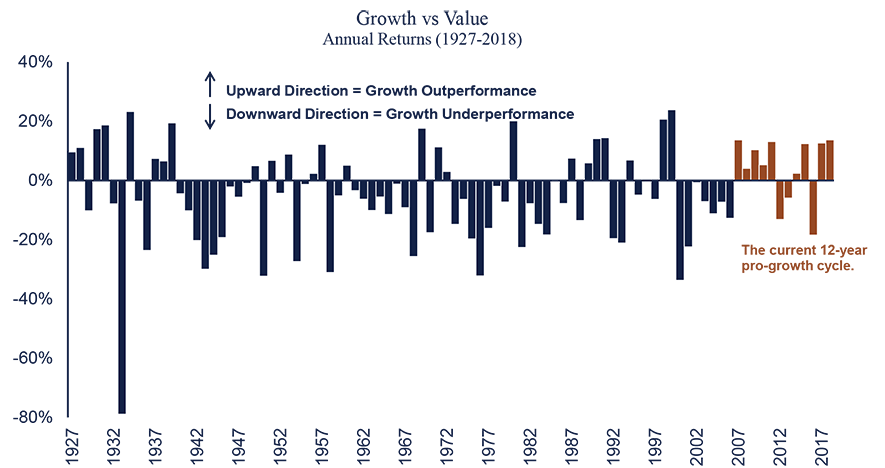

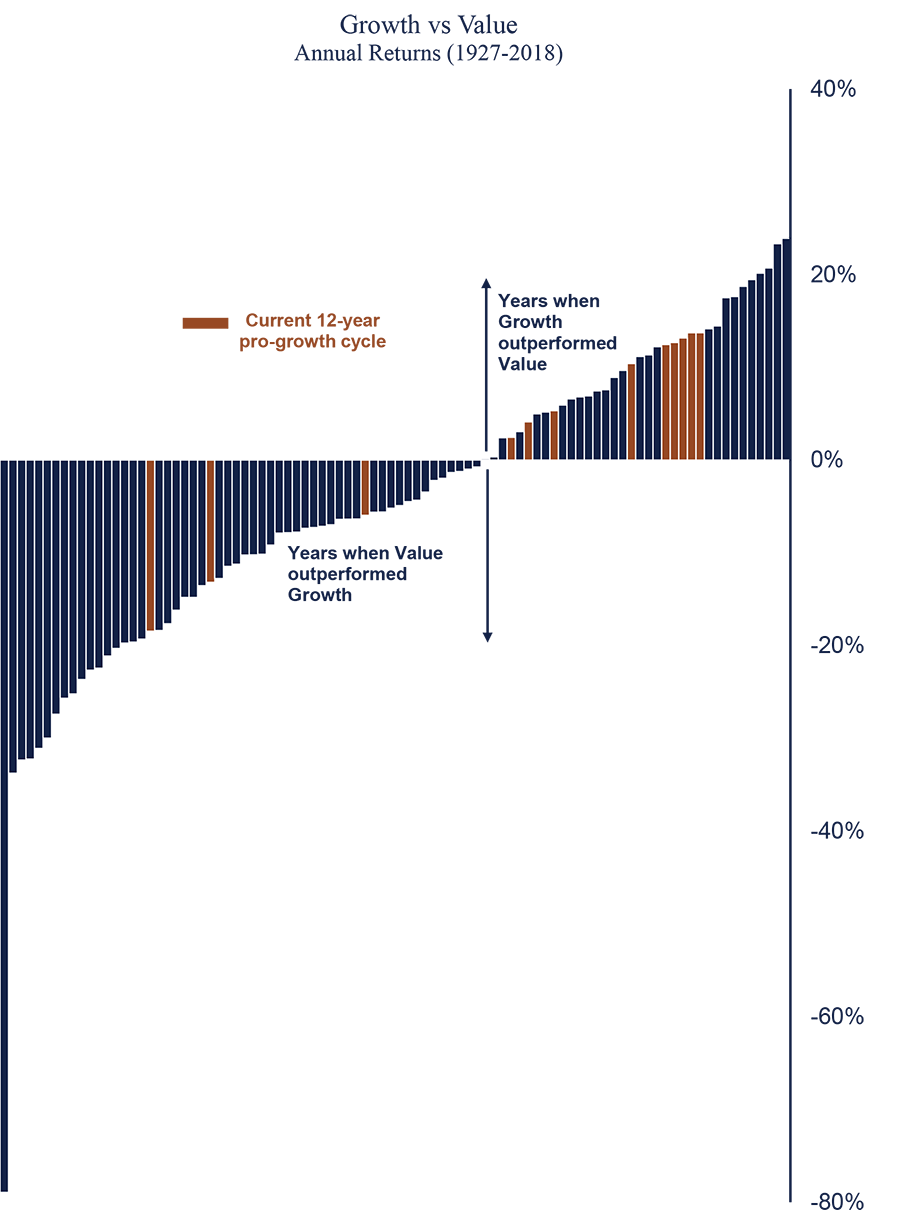

Still, anyone who’s invested in value recently knows that simply targeting the value factor doesn’t result in a guaranteed profit. Value stocks are currently suffering one of their longest stretches of underperformance since the 1930s, underperforming growth nine out of the last 12 calendar years.

Source: Fama/French returns for portfolios formed on book-to-market (value-weighted).

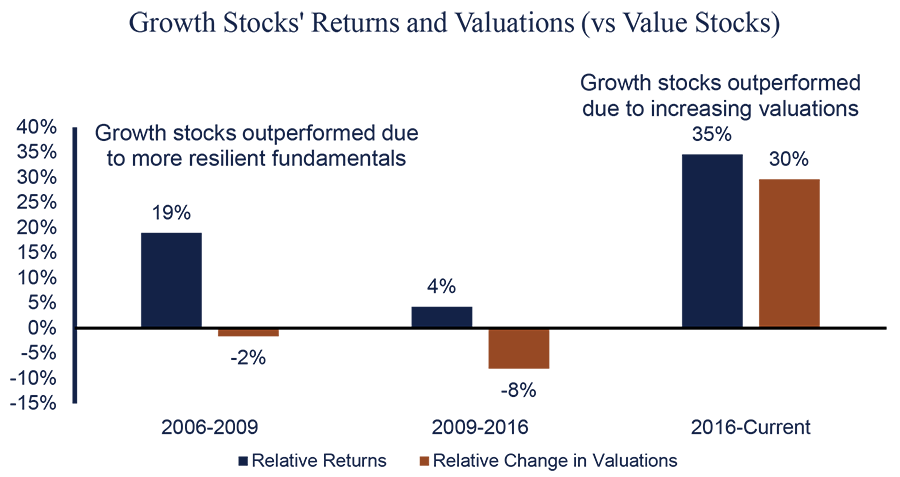

Some of this underperformance is justified. During the 2007-2009 financial crisis, growth stocks outperformed value stocks by 19%, cumulatively; however, growth companies’ fundamentals also held up better than value companies. As a result, growth stocks didn’t become more expensive relative to value stocks, despite significantly outperforming.

From 2010-2016, relative valuations didn’t change much as growth and value stocks exhibited similar performance. However, since 2017, growth stocks have outperformed value by an even larger magnitude than they did from 2007-2009. Some value investors are becoming concerned, and understandably so. Some have even started to question whether value is in a permanent state of decline.

Why We Still Believe in Value

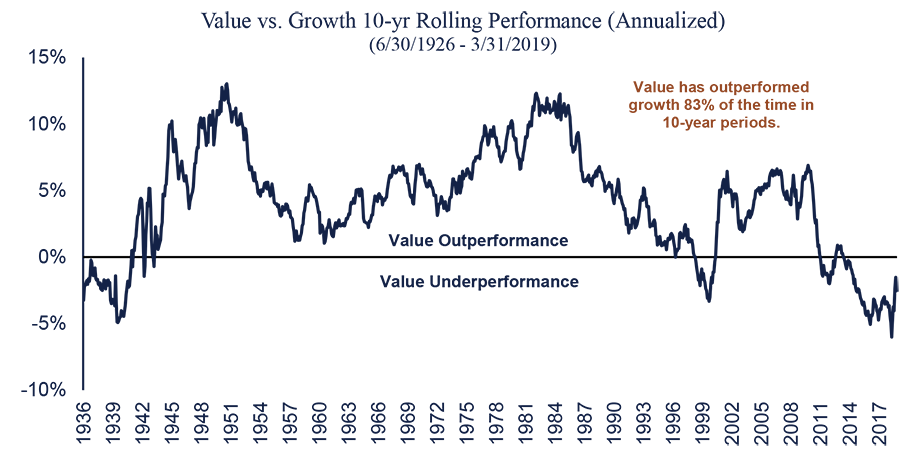

Historically, value’s outperformance versus growth has largely come in cycles. On a rolling calendar-year basis since 1936, growth has outperformed value 39% of the time. Over rolling 10-year periods, growth has outperformed 17% of the time, as shown in the graph below. These statistics help put the recent stretch of underperformance into context. Even over longer periods, value has underperformed growth.

Source: Fama/French returns for portfolios formed on book-to-market (value-weighted).

However, as in times past, we believe patient investors will eventually be rewarded. There are two intuitive explanations for why the value premium exists—and why we believe it will continue to exist into the future.

First, researchers have found that value stocks are typically more sensitive to macroeconomic shocks, such as growth scares. These companies usually have less flexible capital structures and are slower growing, making them less resilient.1 Therefore, to be compensated for the additional risk inherent to value stocks, investors rationally demand that these stocks be priced at a discount. This discount, on average, has resulted in higher returns for value investors.

Second, studies have found that equity analysts tend to exhibit recency bias when formulating earnings expectations.2 In other words, analysts tend to extrapolate growth companies’ recent rapid growth (and value companies’ slow growth) in to the future. However, on average, analysts’ earnings expectations are too bullish for growth companies and too bearish for value companies. As a result, value stocks tend to outperform as they exceed analysts’ depressed expectations.

Since nothing in the last 12 years refutes these explanations, we have no reason to believe that the rationale for investing in value stocks over the long-term has changed. In addition, this recent period of growth outperformance stands in stark contrast to its outperformance from 2007-2009, which we find encouraging. This time, growth’s outperformance hasn’t been driven by stronger fundamentals. Instead, growth is simply becoming more expensive. As prices rise unsupported by fundamentals, continued outperformance becomes less sustainable.

Source: FactSet; Returns and valuations are those of the Russell 1000 Growth and Russell 1000 Value. Data is cumulative. Valuations are based on price multiples to forward-looking earnings, book value, sales and cash flows.

We are also reassured that value’s recent period of underperformance does not overwhelm value’s long-term track record. The chart below illustrates this point. Notice how 1) growth has underperformed value more years than it has outperformed, and 2) the magnitude of growth’s outperformance in recent years (highlighted in red) is not unprecedented. In fact, growth’s best year during this 12-year bull run doesn’t even make growth’s top 10 best years.

Source: Fama/French returns for portfolios formed on book-to-market (value-weighted).

Of course, we cannot predict the future and past performance does not guarantee future returns. However, if history is a guide—and it tends to be a good one—this recent stretch of value underperformance is unlikely to last forever. Value is not dead.

As value investors, we believe that stock prices temporarily drift away from their underlying fundamentals from time to time, but eventually must move back in line with underlying economic realities. Valuations will eventually correct, and value stocks will regain favor. When they do, we believe patient investors will be handily rewarded.

1Cochrane (1991, 1996), Zhang (2005), Winkelmann et al. (2013)

2Livermore et al. (2018)

8596728-06-17

Leave a Reply

Want to join the discussion?Feel free to contribute!