Inflation Continues to Negatively Impact Markets

As turbulence in the markets continues, many investors are feeling unsettled. The inflation report released on Friday, June 10 was worse than expected. In May, prices increased 1.0%, causing the annual inflation rate to rise to 8.6%, the highest since December 1981. Excluding the most volatile categories (food and energy), prices increased 0.6% in May and 6.0% over the last 12 months, indicating that inflation is broad-based and potentially more entrenched than anticipated.

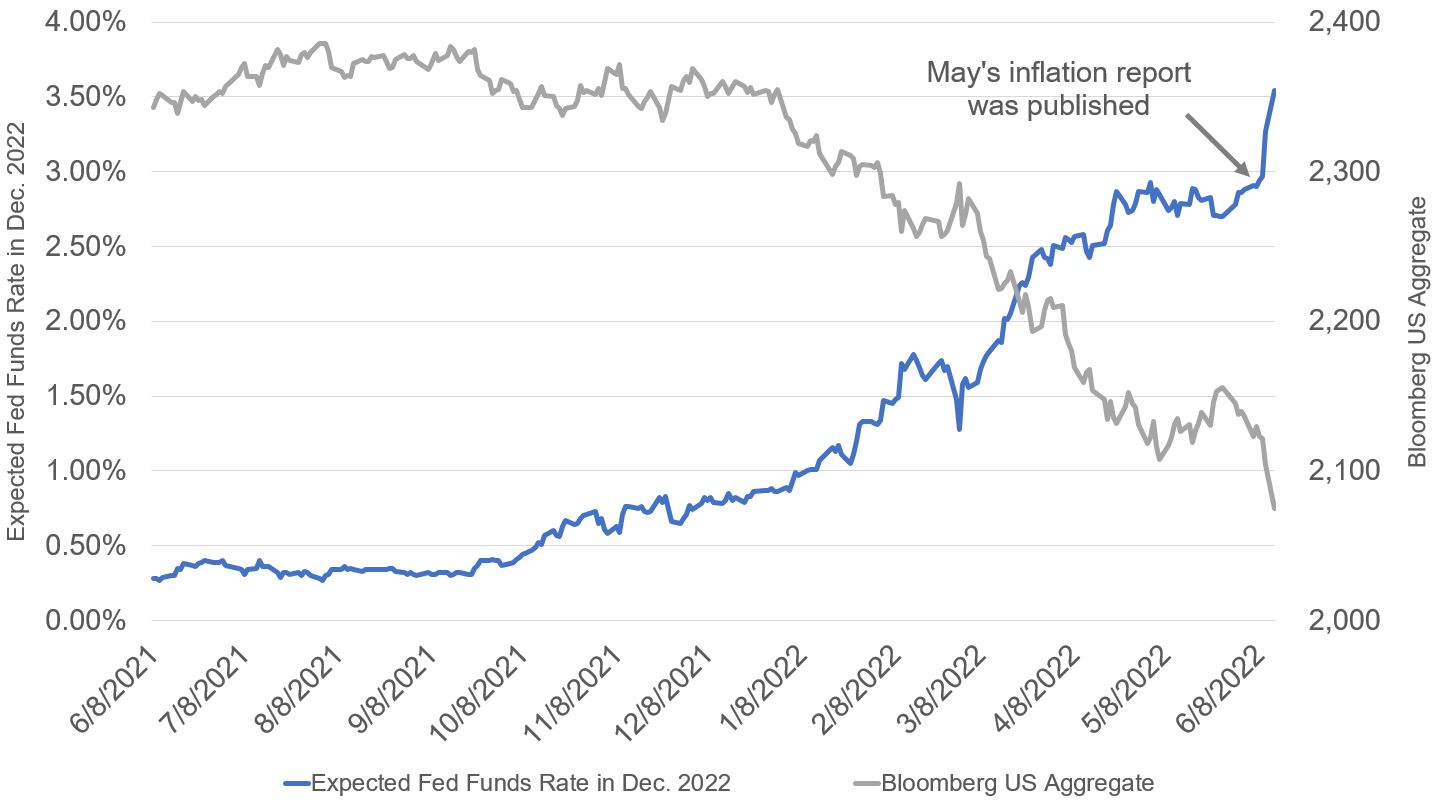

In response, the market now expects that the Federal Reserve (Fed) will have to tighten monetary policy more aggressively to bring inflation under control. For example, on Thursday, June 9 investors expected the Fed funds rate to end the year around 3.0%. As of June 13, it’s now projected to reach 3.5%. The committee’s next scheduled meeting is June 14-15, which should give us more insight into how the Fed plans to proceed.

This sharp adjustment in expectations has caused bonds to tumble, as illustrated by the chart below. Stocks also reacted negatively to the inflation report and have now entered a bear market (-20% decline). In short, high inflation is negatively impacting markets, but what about the economy?

U.S. Bonds Have Moved Inversely to Rate Hike Expectations

Source: CME FedWatch, FactSet

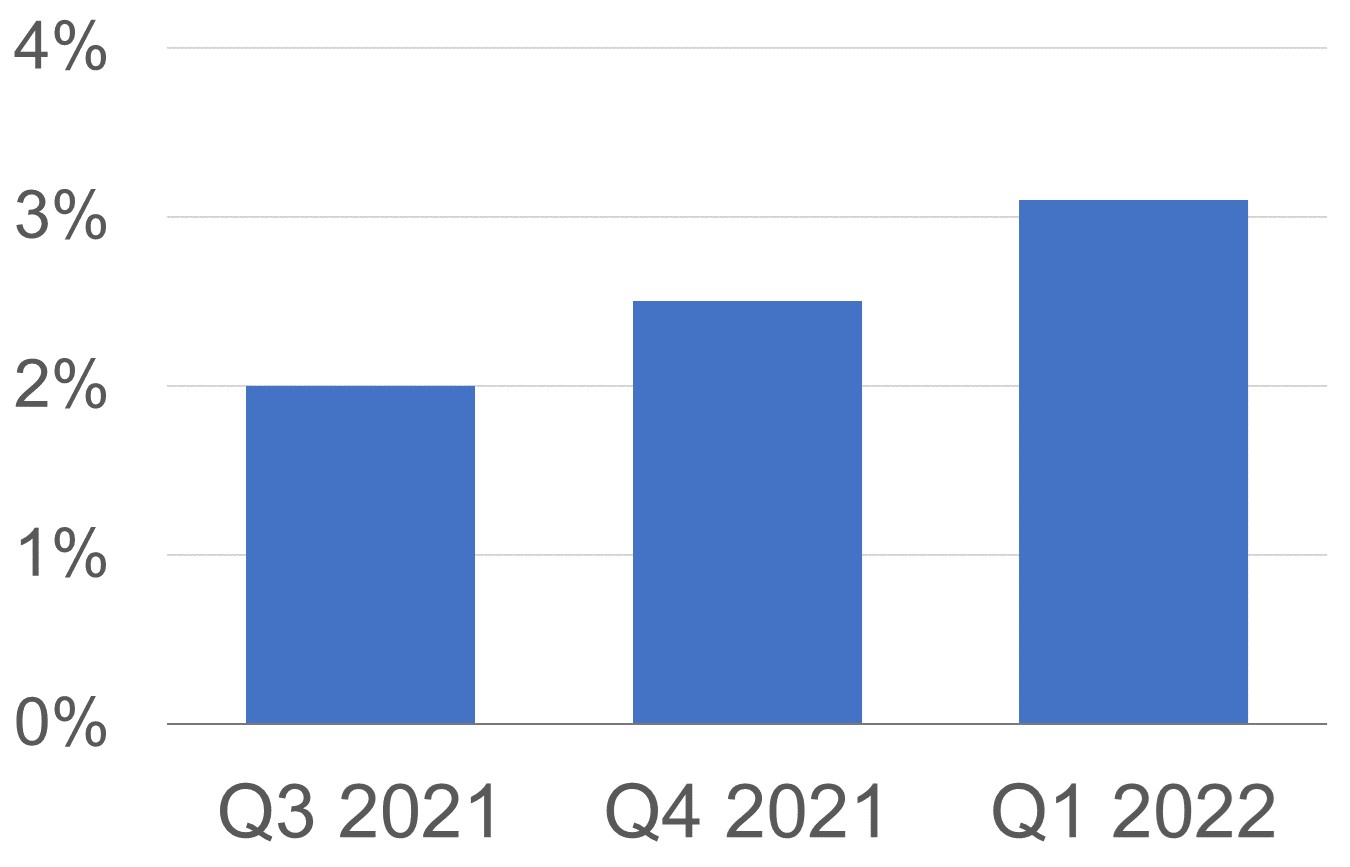

Based on the drawdown in markets this year, investors may worry that the U.S. economy is doomed, especially since the economy declined -1.5% in the first quarter. However, the core economy remains resilient. Over two-thirds of the U.S. economy is driven by consumer spending, which has continued to steadily grow, as illustrated in the chart below. It is important to remember that a recession, which is typically defined as two consecutive quarters of negative growth, hasn’t officially happened yet.

Personal Consumption Expenditures

(quarterly change, real, seasonally adjusted at annual rates)

Source: BEA

Although inflation has plagued consumer sentiment, Americans have not reined in their spending. Instead, consumers have relied on a combination of excess savings, rising wages, and increasing credit to sustain spending trends. Over the next year, personal consumption will likely moderate as consumers shift their focus away from purchasing goods and move toward services in the face of an opening economy and declining support from fiscal programs. Consumers still have high levels of savings, abundant job opportunities, and are not overly indebted, which should add to near-term support for the economy. However, we’ll continue to monitor the slowing impact of higher interest rates on the economy. As for now, whether a recession ensues over the next 12 months remains unclear.

What we’ve seen so far in the markets is a broad repricing in asset valuations because of the Fed’s decision to quickly pivot away from extremely loose monetary policy. Over the last couple of years, valuations stretched higher, which helped drive outsized returns. This year, we’re experiencing some payback from an unwinding of those high valuations.

Looking ahead, there is great uncertainty, which we know is uncomfortable for investors. A war in the Ukraine, COVID lockdowns in China, a green energy transition, high inflation, and rising rates all present challenges, and some investors may see moving to cash as a way to sidestep potential losses. Our experience, however, has shown that investors’ behaviors are just as important to their long-term results as investment market performance. We strongly believe that sticking to an investment plan as markets experience periods of turmoil will bear fruit for investors in the long-term.

We would counsel clients to invest according to their time horizon so that money needed in the short-term is protected against volatility and long-term monies have the best chance of keeping up with inflation. Also, investors may consider diversifying into other investment types, including TIPS (Treasury Inflation-Protected Securities), absolute return strategies, gold, commodities, and private credit, to help protect against the wide-ranging risks that the current environment poses.

Although the current market volatility is unsettling, we work hard to help our clients create sound financial plans that are resilient and capable of weathering the inevitable ups and downs of investment markets. Rest assured that in environments like these, our team looks for opportunities to take advantage of areas in the market that are mispriced or otherwise present attractive return options.