In Like a Lion out Like a _______?

A look at Tariffs, DOGE, and Europe

The new administration has created a whirlwind of activity in its first few weeks. Will the flurry of activity lead to a calm season like the idiom about March’s weather describes? The rain and storms are necessary to replenish moisture and topple the weak and dead trees to make a forest stronger. However, sometimes a strong storm can leave lasting damage. The pursuits of President Trump’s administration are often articulated as separate initiatives, but they have some common themes: Bring back manufacturing to the U.S. and cut government expenditures to help support tax cuts. This blog will look at the impact of tariffs, the creation of the Department of Government Efficiency (DOGE), and the pressure on Europe.

Tariffs

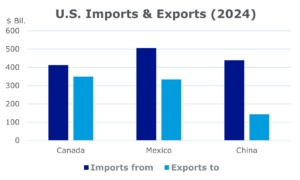

The tariff announcements have been fast and furious. Some, such as the short-lived tariff proposed on Colombian goods, quickly faded from front page news as an agreement to accept deported migrants was reached. Other tariffs, mainly those with Canada, Mexico, and China, are still making daily headlines. The new administration points to trade imbalances with these countries as evidence of unfair trade and loss of U.S. manufacturing over the decades. A secondary issue behind the tariffs is the flow of illegal drugs, particularly fentanyl, into the United States. Ordinarily, the Constitution gives Congress the authority to impose tariffs, but Congress has partially delegated this responsibility back to the President.

Source: Office of the U.S. Trade Representative

The administration may be using tariffs to bring trading partners to the negotiating table. For example, the tariffs on Mexican goods were delayed when their president agreed to combat the cartels and fentanyl crisis. Auto tariffs stalled because of supply chain complexities. Although tariffs may initially raise prices, manufacturers and sellers may absorb some of the costs, lessening the impact on consumers.

Retaliatory tariffs from Canada, Mexico, and China could hurt the export of U.S. goods to those countries. We have already seen nontariff actions occur, including Canada canceling a Starlink contract and imposing a 25% surcharge on electricity sold to the U.S. However, in all of these scenarios, the U.S. is a more important consumer of those countries’ goods than they are of U.S. imported goods.

A primary goal is to eventually bring back manufacturing and jobs to the U.S., but this will take time. Even if tariffs are imposed today, building factories and adjusting supply chains could take years.

The markets generally don’t like uncertainty so the increased tariffs, backtracking on some proposed provisions, and retaliatory tariffs are weighing on the stock market. In the long run, increased U.S. manufacturing could be positive, but if driven by tariffs, it may indicate a lack of comparative advantage, potentially lowering productivity and GDP growth. Targeting certain industries may be more effective than broad tariffs. A trade war could slow global GDP, including the U.S., with Goldman Sachs lowering GDP growth and raising inflation forecasts for 2025 amid the heavy tariff activity.

DOGE

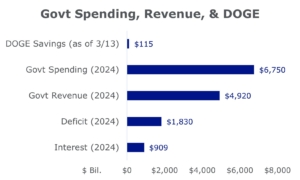

President Trump created the Department of Government Efficiency (DOGE) to identify government inefficiencies, reduce federal spending, and downsize government operations. The estimated savings to date is $115 billion, which includes estimated asset sales and contract/lease cancellations and renegotiations.1 To put this in perspective, the U.S. government’s 2024 spending was $6.75 trillion and the deficit for the year was $1.83 trillion. So, although the savings so far is large, it is only 1.7% of last year’s budget and 6.3% of the annual deficit. However, $115 billion, if realized, could mean significantly less government borrowing and therefore lower borrowing costs.

Source: doge.gov, FiscalData.Treasury.gov

A reduction in government spending and borrowing costs could lead to lower long-term interest rates, which not only benefits the government, but households would also realize lower mortgage rates and borrowing costs. Today’s higher mortgage rates are preventing many Americans from purchasing homes because they can’t afford the interest or already have a mortgage rate well below today’s rates. Corporations would also benefit as their borrowing rates are influenced by U.S. government rates.

The market may have mixed reactions to DOGE. Initial sentiment was positive, but are the cuts arbitrary and does Congress need to vote to make them permanent? A $2 trillion savings was initially floated for cuts so falling substantially short of this goal may be viewed as a negative. However, cutting $2 trillion in government spending would also impact layoffs and outside suppliers, contractors, and consultants. In the end, less government spending, lower deficits, and lower interest rates are positive for both stocks and bonds in the long term.

Europe and Ukraine

Lower government spending, smaller deficits, and lower interest rates could be the result of changes in Europe and the Ukraine war. A ceasefire in Ukraine along with Europe stepping up their defense spending would lessen the burden on the U.S. budget. President Trump’s threat to abandon NATO is forcing Germany and others to reevaluate their own military spending. The new chancellor is proposing to bypass the German debt brake, a constitutional rule that permits only small structural deficits. The first proposal is a €500 billion infrastructure fund to revamp the military and boost the economy over ten years. This spending is roughly 1% of German GDP.

Germany, the largest European economy, has been in a recession for two years and the prospects for 2025 don’t look much better, but a resumption of growth there could help the entire continent. The Ukraine war has not helped the European economies. Besides assistance to Ukraine, much of Germany’s energy needs were met by Russia prior to the war. So, could a ceasefire relieve the budget burden and eventually bring back less expensive Russian energy? For the U.S., a ceasefire could mean less military help for Ukraine. So, if the war ends and European countries can boost military spending, the U.S. budget could have some relief.

Source: FactSet

European stock markets have started the year very strong. The Euro Stoxx 50 is up 9% year-to-date while the German DAX index is up 13%. Military suppliers in Germany are doing particularly well. German bond (Bund) yields are up substantially as well, especially since the chancellor’s plan to increase the deficit. These higher yields in Europe along with falling U.S. rates this year have strengthened the euro in comparison to the dollar. A stronger euro boosts positive returns for U.S. investors in European stocks.

Summary

The uncertainty of policies and their timing is driving short-term movement in the stock and bond markets. Companies don’t like policy uncertainty either. On balance, these initiatives may have positive implications in the long term but over the near term, there are challenges.

No one knows what the future holds or how these programs will impact the economy or the markets, but we have summarized below how these issues may affect the market and economy in the short and long term.

*Subject to change. Some exemptions/delays for goods covered by USMCA.

If you would like to learn more about our investment philosophy or offerings or have specific questions about your portfolio, please contact your Blue Trust financial advisor. If you do not have a Blue Trust advisor and are interested in speaking with one, please reach out to info@bluetrust.com or call 800.841.0362.

For more insights and real-time reflections, follow Brian McClard, Chief Investment Officer, on X (formerly Twitter).

1 www.doge.gov/savings. As of 3/13/2025.

CAS00001297-03-25