How Diversified are Market Cap Indexes?

August 20, 2019

“Don’t put all your eggs in one basket” is one common piece of advice that can be especially relevant to investing. Investors of all types recognize the importance of diversifying. Its value goes beyond common sense benefits like avoiding single-stock, catastrophic risks (e.g., bankruptcy) to statistical benefits like reducing portfolio volatility. Yet, many investors unknowingly fail to take full advantage of diversification’s benefits.

In recent decades, passive investment strategies that track common market indexes have surged in popularity. Their low-cost, straightforward methodology has attracted enormous amounts of investor capital. On the surface, they also seem well-diversified, but even the broadest passive strategies are significantly more concentrated than many investors realize.

Take the S&P 500, for example. Comprising the largest 500 U.S. stocks, it’s probably the most popular equity index. Hundreds of billions of dollars are invested in passive funds that aim to replicate the S&P 500. And why not? Five hundred companies seem like more than enough to fully capture the benefits of diversification. The problem is that the S&P 500’s market cap-weighting methodology results in a very top-heavy allocation.

To illustrate, listed below are the S&P 500’s allocations to its top holdings.1

- Top 10: 21%

- Top 50: 50%

- Top 100: 66%

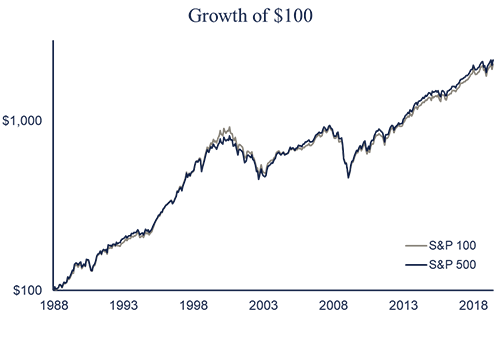

In comparison, the bottom 400 stocks receive an immaterial weight, so it’s unsurprising that since 1988 the top 100 stocks’ annualized performance (as represented by the S&P 100) is only 0.2% different from the S&P 500’s performance. It seems the S&P 500 doesn’t provide much diversification beyond the top 100 stocks.

Source: FactSet. Total returns are from 1/31/88-6/30/19.

Some investors, out of a desire for broader exposure to the U.S. equity market, have chosen passive funds that include hundreds (or even thousands) of additional mid- and small-cap stocks. Unfortunately, passive funds that employ a market cap-weighted methodology provide little incremental diversification by expanding the investment universe.

The S&P Composite 1500, for example, consists of the largest 1,500 U.S. stocks, providing exposure to the 500 large-cap stocks of the S&P 500 plus 1,000 mid- and small-cap companies. With three times as many holdings as the S&P 500, you might expect the S&P 1500 to be significantly more diversified. However, the extra 1,000 stocks make up only 9% of the index. Said another way, the S&P 500 accounts for an astounding 91% of the S&P 1500’s market cap.2

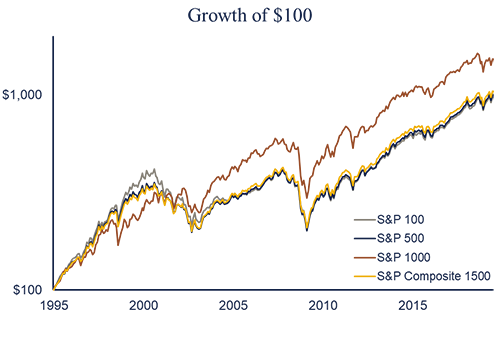

Once again, it’s not surprising that (apart from the dot-com bubble) the S&P 100, S&P 500 and S&P 1500 have performed almost identically since 1995 (their earliest common inception). To illustrate the extent to which passive strategies’ market cap weighting scheme diminishes the incremental diversification from including 1,000 additional stocks, the S&P 1000, which represents the 501st to 1,500th largest U.S. stocks, is also plotted on the chart below. Those 1,000 mid- and small-cap stocks greatly outpaced the S&P 500, yet the S&P 1500 barely reaped any benefit from their inclusion due to its concentration in the largest 500 stocks.

Source: FactSet. Total returns are from 1/31/95-6/30/19.

One conclusion could be that there’s no reason to hold more than the top 100 stocks. Holding 500 or even 1,500 stocks makes little difference when market cap-weighting. The more important takeaway, though, is that many passive strategies don’t take full advantage of diversification’s benefits. Likewise, their investors may believe that they are more diversified than they actually are. With respect to a more broadly diversified portfolio, comparing performance to a single market-cap benchmark like the S&P 500 might not always be relevant. A truly diversified portfolio will perform very differently than a concentrated index. Consequently, the performance comparison may not provide much insight into whether you’re making progress toward your goals. Performance evaluation should always consider your portfolio’s characteristics and objectives, which are more important than tracking an index.

1 Source: Morningstar Direct. As of 6/30/19. Based on the holdings of the Vanguard S&P 500 ETF.

2 Source: S&P Dow Jones Indexes. As of 7/31/19. Based on the S&P 500’s and S&P Composite 1500’s total market cap.

8856173-08-19

Leave a Reply

Want to join the discussion?Feel free to contribute!