From Campaigns to Economic Change: A Pre-Election Overview

Executive Summary

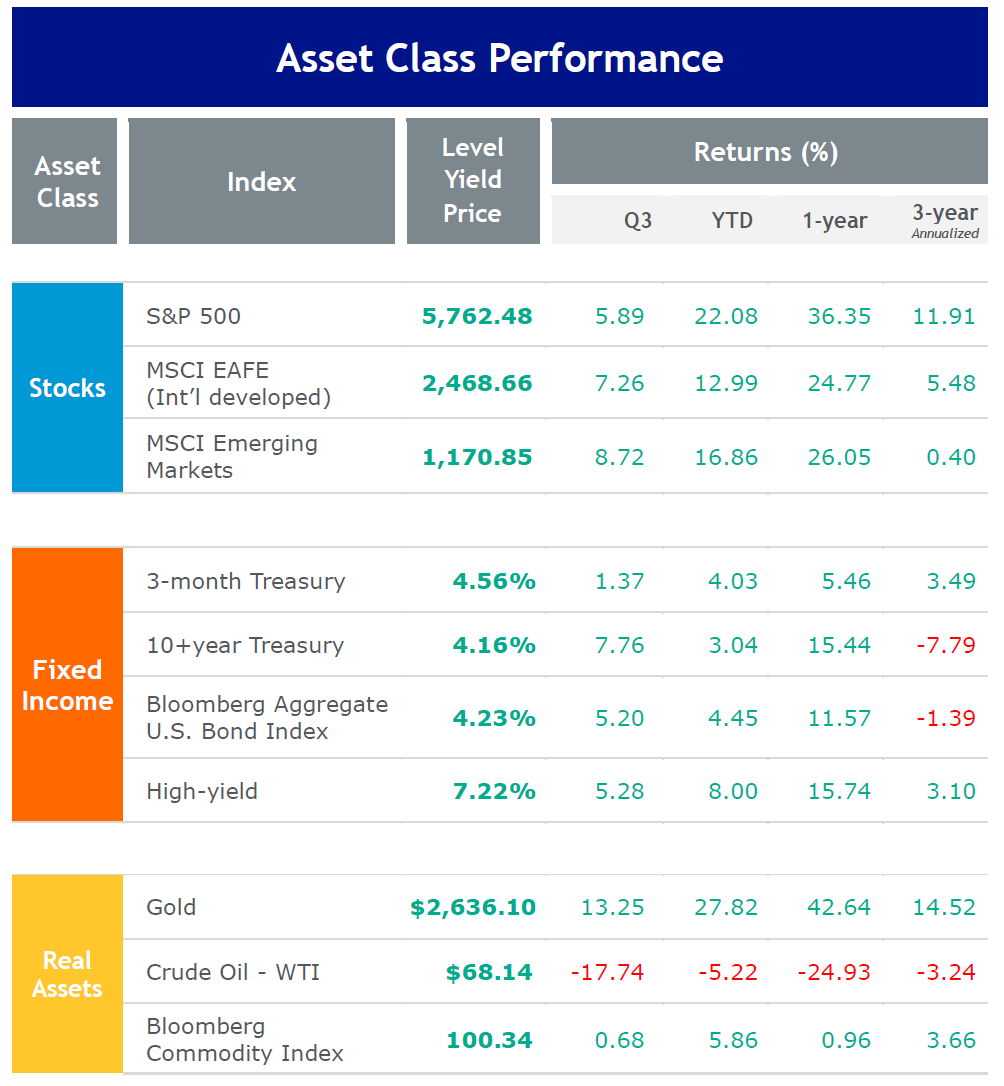

In September, the U.S. Federal Reserve (Fed) reduced the federal funds rate by 0.5%, its first cut since 2020. This decision contributed to a strong rally in the equity markets, with the S&P 500 achieving multiple all-time highs. Notably, small- and mid-cap stocks outperformed larger companies and bond markets rallied as interest rates decreased.

Inflation measures have cooled, with the Consumer Price Index reaching 2.5%, while the labor market shows signs of loosening, raising recession concerns. Over the summer, Vice President Kamala Harris emerged as the new Democratic presidential nominee following a series of unexpected political events. Donald Trump is the Republican nominee for the third presidential election in a row and is seeking a historic non-consecutive second term. Polls suggest a close race, with inflation likely top of mind as voters cast their ballots.

The political landscape indicates that tariffs will remain contentious, with Trump advocating for significant increases and Harris seemingly supportive of targeted tariffs. Fiscal policies from both parties suggest large deficits will continue, with significant implications for monetary policy and economic growth. Ultimately, the U.S. economy’s resilience may buffer it against potential election-related turmoil, although political dynamics will remain crucial.

Economic and Investment Review

The Fed Cuts at Last, and Markets Continue to Rally

At its September meeting, the U.S. Federal Reserve (Fed) reduced the federal funds rate by half a percentage point, down to 4.75% to 5%. The cut was the first since 2020 and the first rate adjustment since July 2023, when the central bank ended an 18-month tightening campaign aimed at tempering inflation by lifting the key rate to a 22-year-high. While the Fed’s policy statement noted that “the economic outlook is uncertain,” Chair Jerome Powell said, “The U.S. economy is in good shape. It’s growing at a solid pace, (and) inflation is coming down.” The Consumer Price Index eased in August to a 12-month rate of 2.5%, while the Fed-favored personal consumption expenditures rate fell to 2.2%. Both measures extended a streak of cooler readings and reached three-year lows. Meanwhile, the U.S. labor market continued to soften amid slowing job and wage growth. The August jobless rate reached 4.2%, well above a year ago, as job openings have declined amid increased labor market participation.

During the third quarter, the S&P 500 Index hit multiple all-time highs and recorded its fifth straight quarterly gain, bolstered in part by the Fed’s move. In a shift from long-term trends, small- and mid-cap stocks outperformed large-caps, while value broadly beat growth. International developed market and emerging equities also gained. The gains for the quarter came despite an early August surge in volatility. Global markets pulled back sharply as weaker-than-expected U.S. labor data fueled fears of a recession, and a surprise interest rate hike by the Bank of Japan forced a recalibration across numerous asset classes, but the pullback was short-lived. Bond markets generally rallied as U.S. Treasury (UST) yields declined. Commodity price volatility was high, with prices hitting multi-year lows amid demand concerns before recovering to finish the quarter essentially flat.

Source: FactSet, 3-month Treasury – ICE BofA U.S. Treasury Bill (3 M), 10+ year

Treasury – ICE BofA U.S. Treasury (10+ Y), U.S. Aggregate – Bloomberg U.S.

Aggregate, High Yield – Bloomberg U.S. High Yield – Corporate, Gold – NYMEX Near

Term, Crude Oil – NYMEX Spot

Blue Trust Insights

Election Season

Entering 2024, we reflected on the historic nature of this election year, with more than half the world’s population heading to the polls. However, no one could have foreseen just how hectic this election year in the U.S. would become. During just 24 days this summer, we witnessed a shocking series of events: a presidential debate disaster for the incumbent, an assassination attempt on a former president, and the surprising withdrawal of the sitting president’s bid for reelection after the primaries.

With approximately 100 days until the election, Vice President Kamala Harris became the presumptive Democratic party nominee. Party leaders quickly coalesced around her, creating a necessary strategy reset in both campaigns. Poll numbers indicate that the race will come down to a few states―or even counties―and will likely be decided by razor-thin margins.

If Donald Trump wins in November, he will become only the second president in U.S. history to win a non-consecutive second term. Grover Cleveland was the first when he served as the 22nd and 24th president from 1885 to 1889 and 1893 to 1897. If Kamala Harris wins, she will become the first woman elected to the nation’s highest office. Regardless of the outcome, history will be made, adding to a growing list of history-making moments in the 2024 election cycle.

What to Make of the Polls

In the immediate aftermath of one of the most jarring periods in U.S. political history, polling data indicated a surge in Harris’ support, showing Trump down nationally and in key battleground states. Nearly three months after Harris’ rise to the top of the ticket, polls now indicate a much closer race.

After the 2016 and 2020 elections―when Trump significantly outperformed expectations―it’s logical to question the reliability of pre-election polls. A special task force convened by the American Association for Public Opinion Research found that 2020 marked the worst pre-election polling error in over 40 years. For example, pre-election polling had Joe Biden ahead of Donald Trump by more than 8 percentage points in Wisconsin. President Biden went on to eke out a win in the state by 0.6%. A similar story played out in other states. Because of the polling error we’ve witnessed in the prior two cycles, it would not be surprising to see Trump outperform expectations in November.

Key Issues Shaping Voter Opinions

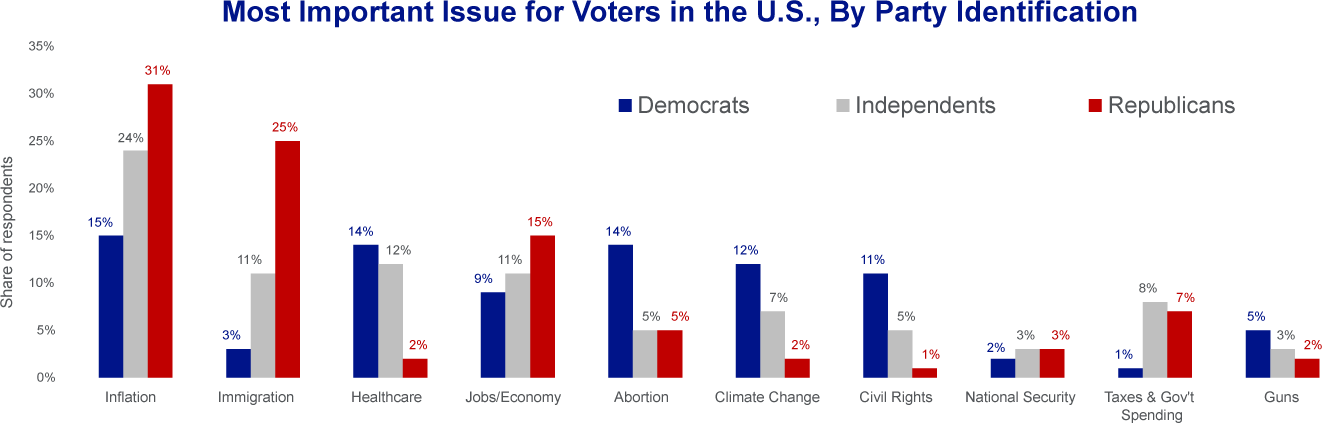

What will voters focus on when they cast their ballot in November? Although immigration, healthcare, and the economy will surely have a substantial influence, many believe inflation will be at the top of the list. Although we have avoided a recession thus far, many consumers feel the pain of higher prices. On a year-over-year basis, inflation has finally dipped below 3%. However, on a cumulative basis, prices are up over 20% since 2021. How consumers―particularly in swing states―choose to view inflation (on a year-over-year or cumulative basis) will likely have a significant impact on the election outcome. The Bureau of Labor Statistics reports on U.S. inflation data in four census regions and nine divisions. The recent data shows that prices have increased the most in the Mountain and South Atlantic divisions, home to the key swing states of Arizona, Georgia, and North Carolina. However, prices have increased less aggressively in the Middle Atlantic division, home to the crucial battleground state of Pennsylvania. Many experts view Pennsylvania as the tipping point state in this election, with the state’s winner likely heading to the White House.

Source: YouGov; The Economist, Statista

Based on President Trump’s use of tariffs in his first administration and his outspoken plans for his second term, it is clear that he is a strong believer in utilizing tariffs to boost government revenue and keep foreign adversaries―and allies―in check. He has floated the idea of a 10% across-the-board tariff on all goods entering the U.S. in addition to a 60% tariff on Chinese imports.

Politically, this proposal is good rhetoric as Trump’s tariff proposal has likely energized those in rural America who feel forgotten after decades of globalization have left behind the hollowed-out shell of a once robust manufacturing base. Although some of his tariff ideas, such as replacing the federal income tax with tariffs, are unlikely to come to fruition, we think the former president would attempt to come down hard on countries he believes are treating the U.S. unfairly. However, Trump may simply use the threat of tariffs as a negotiating tactic and target only the worst offenders rather than paint with a broad brush as his current proposal indicates. Moreover, the extent to which a president can change tariff policy is limited without congressional support.

Economists estimate that 10% across-the-board tariffs would lead to a minor decrease in U.S. gross domestic product (GDP) growth and a moderate increase in inflation, at least in the first year. Some estimates show that the data would actually improve from the baseline scenario thereafter. This outcome could slow the Fed’s monetary policy response as inflation may remain higher than expected; however, the inflationary increase would likely be a one-time bump as prices adjust rather than a new period of increasingly higher inflation.

Tariffs are typically seen as a tax that is ultimately paid by the end consumer, but the importer actually decides how much of the cost to pass on. For example, a 2021 study found that most of Trump’s first-term tariffs were paid for by U.S. importers in the form of lower margins1. With historically high margins in the U.S., companies may continue absorbing price increases resulting from tariffs. Still, prolonged margin deterioration―and potential retaliatory tariffs―could eventually lead to layoffs in some industries.

The Chinese economy will likely be the biggest loser if Trump is elected and follows through on his current tariff plan. During the first round of tariffs in 2018-2019, data from Goldman Sachs show that Vietnam, Mexico, India, Italy, and Cambodia emerged as the biggest beneficiaries of U.S.-China trade deviations, accounting for over 80% of tariff-driven diversions. Although U.S. and Chinese equities had nearly identical performance over the entirety of Trump’s presidency, Chinese equities underperformed the S&P 500 by nearly 30% from 2018, when tariffs were initiated, through the end of Trump’s presidency in 2021.

A hawkish China stance might be the only major area where both parties can find some common ground. Notably, the Biden administration has opted to keep Trump’s China tariffs in place. Recently, the Biden administration also increased tariffs on Chinese electric vehicles. A Harris campaign spokesperson has said that her administration would utilize targeted and strategic tariffs. It’s clear that regardless of which party takes office in 2025, U.S.-China relations will remain tense, and tariffs will continue to play a role in foreign policy, though likely to a greater extent under a Trump presidency.

Taxes, Deficits, and the Fed

If re-elected, former President Trump has made it clear that he intends to extend the Tax Cuts and Jobs Act (TCJA), which has many provisions set to expire in 2025. Additionally, he has floated the idea of decreasing the corporate tax rate to 15% for companies that make their products in the U.S. and exempting Social Security income from taxation. Vice President Harris has stated her intention to increase the corporate tax rate to 28%, up from the current rate of 21%.

Congressional Democrats would likely look to retain some of the personal tax cuts from the TCJA. Both parties, either through decreased taxes or increased spending, are geared toward large deficits. A looser fiscal environment would boost short-term growth but likely pressure inflation and interest rates, putting the Fed in a difficult spot. Control of Congress will be critical, ultimately deciding the degree to which either party can carry out its fiscal ambitions.

Some of those ambitions include addressing the cost of childcare and housing. In addition to capping the cost of childcare at 7% of household income, Harris has pledged to increase the child tax credit and seek to provide support to new homeowners via downpayment assistance. An additional part of her housing plan incentivizes local governments to remove regulations that prevent additional construction. The Trump campaign is also entertaining the idea of increasing the child tax credit, and the former president has said he would establish low-tax zones on federal land to encourage construction companies to build new homes.

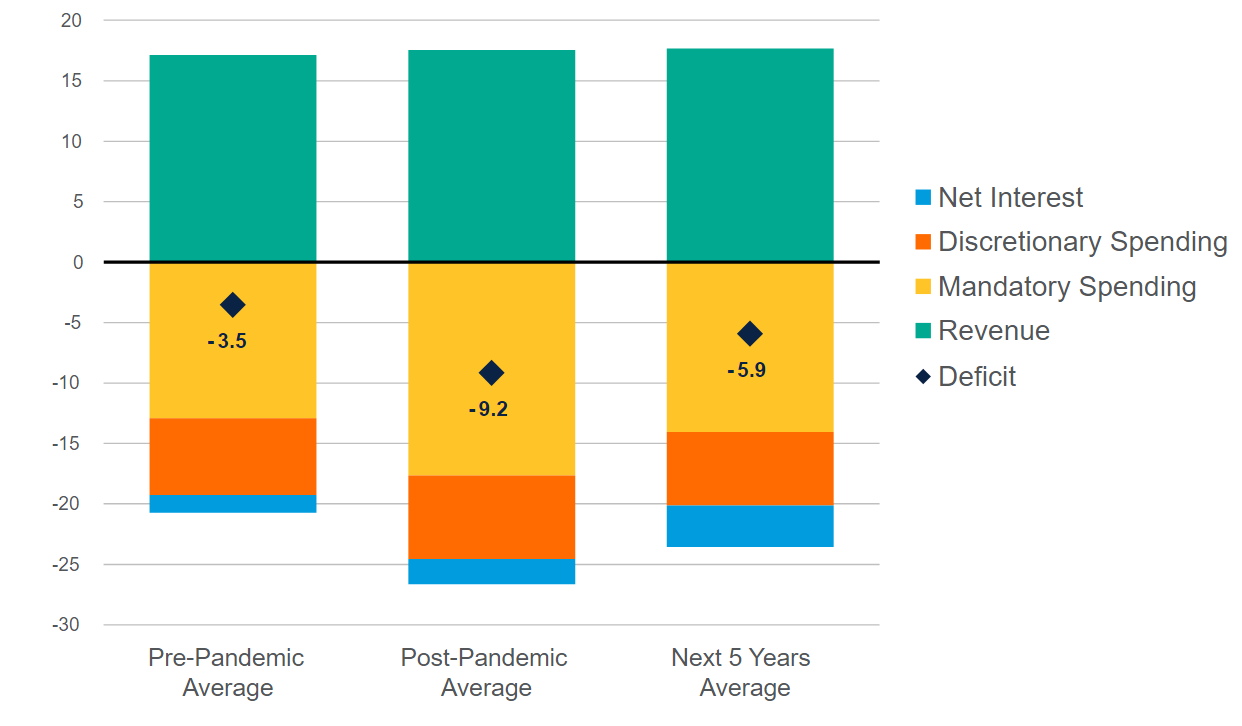

The first Trump administration and the current Biden administration have both overseen historically large deficits as a percentage of GDP, albeit for different reasons. Under a second Trump administration, we expect an attempt to undo much of the planned climate-related spending passed as part of the Inflation Reduction Act. As part of reducing wasteful spending, Trump has pledged to establish a government efficiency commission to audit the federal government and eliminate wasteful spending. Continuing his first administration’s deregulation policy, he also vowed to cut ten government regulations for every new regulation implemented.

The U.S. has not had a budget surplus since 2001, and there is little relief in sight as both parties’ policies are estimated to increase the deficit in the years ahead. The Congressional Budget Office expects deficits to remain above 6% of GDP over the next ten years.

Actual and Estimated Deficit as a Percentage of GDP

Source: Congressional Budget Office (CBO)

Excessive government spending hinders monetary policy. Since the Global Financial Crisis, interest rates have mostly remained low, making debt affordable, but borrowing costs have increased precipitously in the post-pandemic years. The Fed will have a difficult balancing act in the months and years ahead as it would like to return to a lower interest rate level while not reigniting inflation.

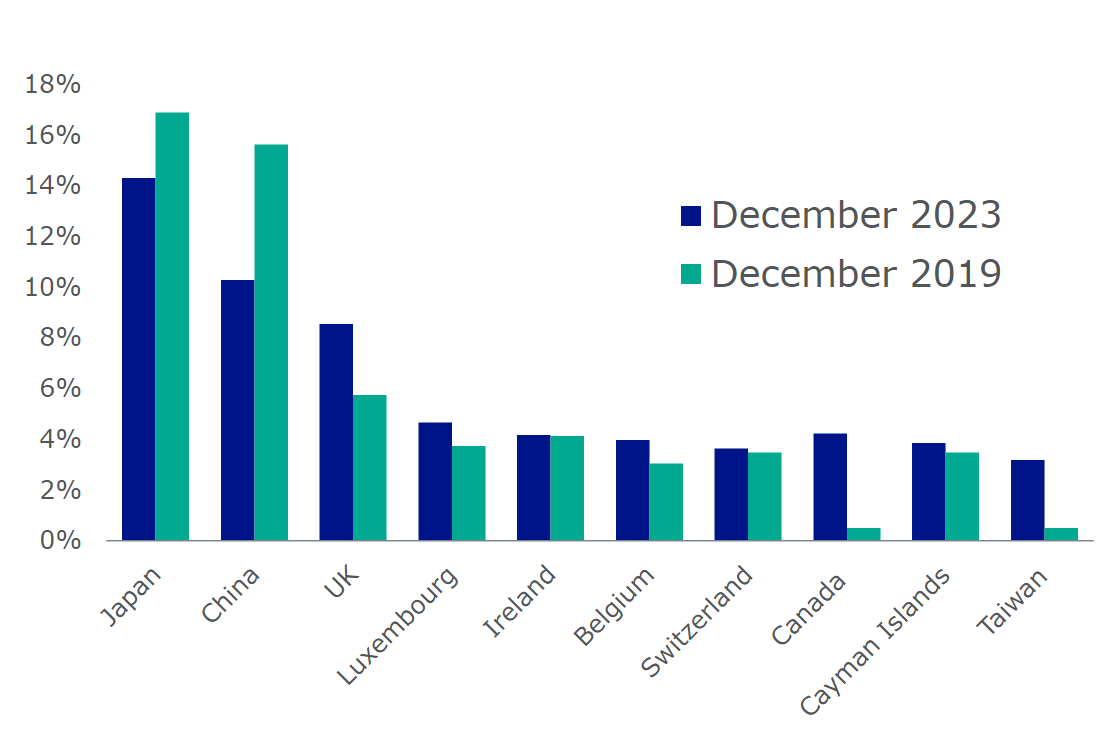

Experts expect the U.S. debt level to pass $35 trillion in November and net interest payments to be on par with or exceed defense spending for the first time. Concerns about America’s growing debt are not new, but the U.S. has avoided significant consequences so far. Worries remain as onlookers fear that the dollar’s status as the global reserve currency is in jeopardy. Indeed, some actions taken against Russia, for example, may lead some countries to reconsider their reliance on the greenback. Many have predicted that foreigners will retreat from the U.S. Treasury market. So far, that fear has not been justified by data, as foreign ownership of Treasuries remains robust, with China being an obvious outlier. Japan is the largest holder of the approximately 29% of total U.S. debt owned by foreign countries.

Percentage Held of Foreign-Owned U.S. Debt

Source: U.S. Department of the Treasury

Conclusion

The United States is in a unique position. It boasts the largest and most dynamic economy on earth, while also enjoying the dollar’s status as the global reserve currency. While this powerful combination provides breathing room to work out the nation’s fiscal troubles, austerity is a losing political strategy, and no party in Washington seems prepared to confront these challenges head-on.

One person’s ability to change the nation’s course is limited, and as Romans 13:1(b) tells us, “…there is no authority except that which God has established. The authorities that exist have been established by God.” Over the long term, businesses will innovate, companies will hire, and life will go on as the president is subject to checks and balances. For those concerned that an election will alter the course of markets and the economy, we invite you to read our blog post from earlier this year. Though there will be bumps along the way, we believe that America’s economy and stock market will power higher over the long term, regardless of which party is in power.