Does Your Stock Portfolio Care Who Is President?

March 8, 2024

It’s election season! A heart-warming time of constructive debates, encouraging political ads, and unbiased news that we all look forward to, right? Not exactly, but regardless, it is a time when opinions are polarizing, and data is often lacking. In this piece, we will share some insights on the importance (or unimportance) of politics for the economy and stock market.

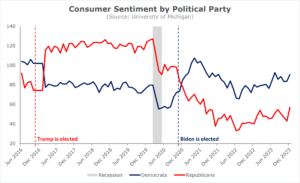

First, it’s helpful to realize that most peoples’ party affiliation impacts their perception of the economy. This observation appears to be increasingly true as politics have become more divisive in recent years. Take, for example, the University of Michigan’s Survey of Consumers, which illustrates how people’s opinion of the economy is influenced by whether their political party controls the White House.

Of course, the media is happy to fan these biases. We’re constantly bombarded with headlines such as…

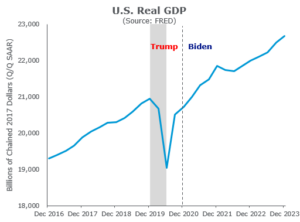

However, the U.S. economy and stock market actually performed well under both the Trump and Biden administrations.

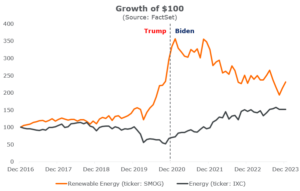

How could it be that two very different presidents governed over such similar economic and market outcomes? Leaders and their policy agendas matter; however, larger forces like underlying economic conditions and market fundamentals matter more. For example, the Trump administration was much more friendly toward oil and gas companies than Biden’s administration has been. Biden has preferred renewable energy sources. So it might be surprising to learn that renewable energy companies’ stocks soared during Trump’s tenure while traditional energy companies languished, and the exact opposite has occurred under Biden.

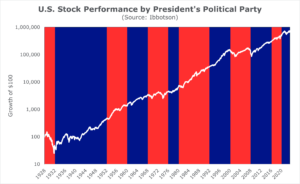

When we zoom out and examine the last 95 years, the data confirms recent history. Sure, there have been outlier periods (like those associated with the Great Depression and the so-called “lost decade” for stocks, which occurred from the dot-com bubble to the Great Recession). Still, stocks have generally appreciated under both Republican and Democrat presidents. This data supports our belief in the importance of staying invested regardless of who’s in office.

We’re not implying that politics don’t matter. Leaders can influence the productivity of the people they lead. By creating environments with greater civil and economic freedom, they can provide fertile ground for investment and wealth creation. For this reason, public policy can have a meaningful impact on growth. For instance, reducing tariffs, quotas, and other trade restrictions would provide a tailwind for growth. A reduction in burdensome business regulations would also boost economic growth.

It is important to remember that the current political environment is just one of many factors that drive the ultimate success of an equity market. In the U.S., elections and political developments are typically too short-lived to have a pronounced and lasting effect on long-term assets like stocks. Most publicly traded companies’ value is derived from future cash flows—related to factors like population growth, capital investment, and innovation—well beyond a president’s four-year term. What’s more important are the systems and institutions that outlast elected officials, which only change gradually. And, if Americans believe policies need adjusting, they need only wait two years until the 2026 midterm elections to issue a course correction.

That’s not to say that policy uncertainty and heated campaign rhetoric couldn’t lead to short-term volatility as the election approaches, but we would view any such dislocations as a potential long-term opportunity. Ultimately, we rest in God’s faithful control over all things. Acts 17:26 says, “From one man [God] made all the nations, that they should inhabit the whole earth; and he marked out their appointed times in history and the boundaries of their lands.” Based on this, we believe the next president and the future of our country are under the control of the Lord of Lords and King of Kings, our Savior, Jesus Christ.

For more election charts and other insights, follow Brian McClard, Head of Investments, on X (formerly Twitter).