5 Financial Planning Tips for Recent College Graduates

Written by Nathan Lackey, Financial Planner for Blue Trust

In my experience and conversations with young professionals, college graduates often do not receive enough coaching on making wise financial decisions. Thankfully, the Bible has a lot to say about money, and it is never too late to implement financial discipline! Here are some tips for building a sound foundation after graduation.

- Set Financial Goals – “The plans of the diligent lead surely to abundance, but everyone who is hasty comes only to poverty.” Proverbs 21:5

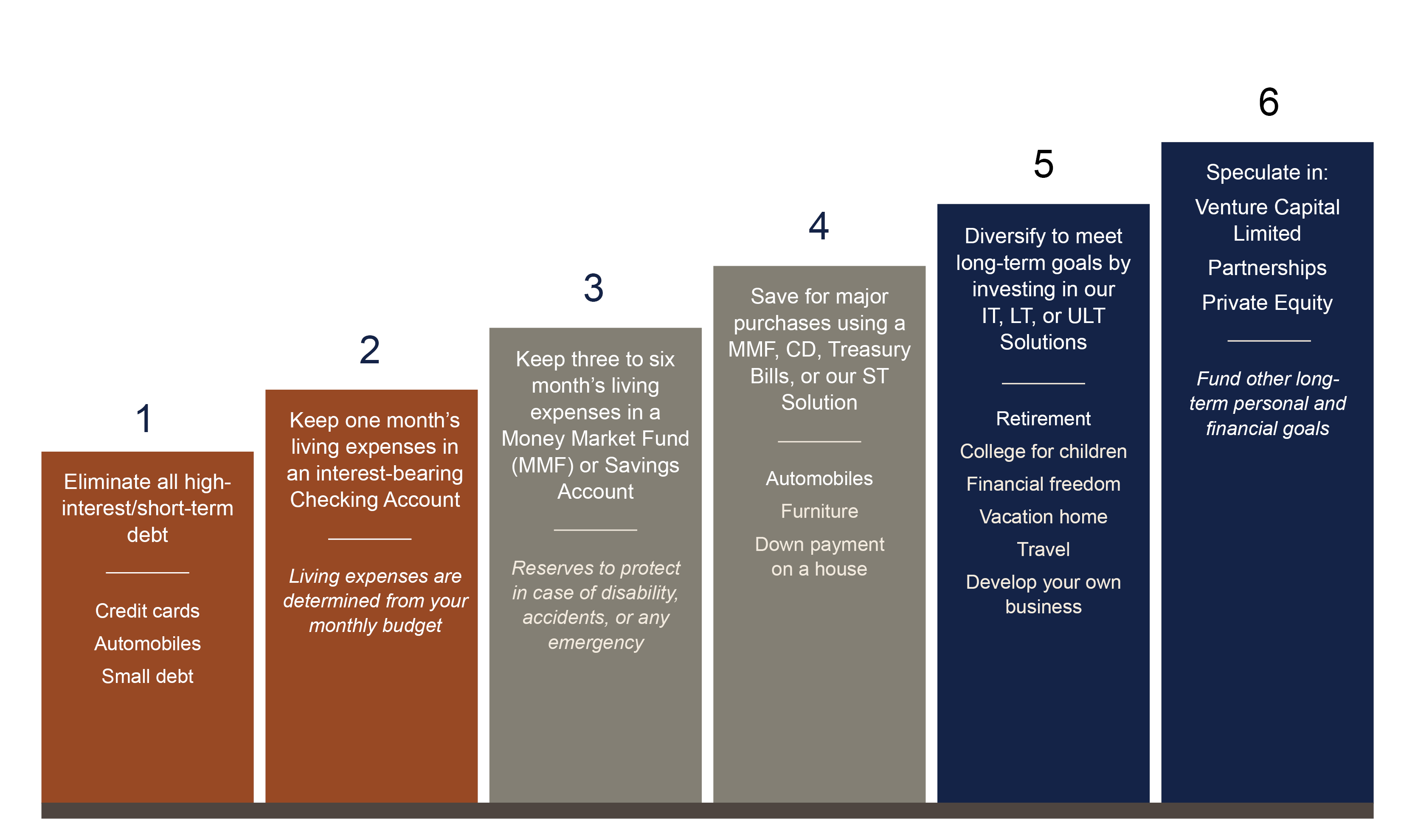

- Set goals. Wise financial planning begins with setting short, intermediate, and long-term goals and allocating resources accordingly. The graph below illustrates how your savings and investing strategy could be tied to specific financial goals.

- Build an emergency fund. Establish an emergency savings fund with 3-6 months of expenses to cover unexpected events (car repairs, job loss, etc.)

- Save for major short-term purchases. If you anticipate making a big purchase in the next 1-3 years, the stock market may be too risky for the money you need to save; meaning you may have to sell your positions when they are significantly down at the time you need the cash. Consider a high-yield savings account for near-term purchases like a house down payment, engagement ring, new car, etc.

- Track Your Expenses – “Be sure you know the condition of your flocks, give careful attention to your herds.” Proverbs 27:23

- Spend less than you earn. A simple way to build wealth is to spend less than you make and do it for a long time. The problem is that most people do not know how much they are spending.

- Utilize a cash flow plan. Consider creating a budget through a tracking system like Mint or YNAB. Even if you hate the idea of a budget, tracking your expenses to know how much you are spending and where it is going is a helpful starting point.

- Start Saving for Retirement – “Wealth gained hastily will dwindle, but whoever gathers little by little will increase it.” Proverbs 13:11

- If available, consider a Roth 401(k). Most individuals under age 30 are in the lower earning income years of their life. With a Roth 401(k), you pay taxes during your relatively low-income earning years and let your investments grow tax-free for 40+ years. This strategy allows you to take tax-free withdrawals in retirement when you are likely in a higher tax bracket.

- Target a savings rate. Aim to save 10-15% towards retirement each year. At a minimum, take advantage of your company’s 401(k) match.

- Depending on your health situation, choose the High-Deductible Plan to open a Health Savings Account (HSA). This account has tax advantages through tax-deductible contributions, tax-deferred growth, and tax-free withdrawals (for qualified medical expenses). It also rolls over year to year, is a great savings vehicle for future health expenses, and can be treated similarly to a retirement savings vehicle after age 65.

- Give Generously – “One person gives freely, yet grows all the richer, another withholds what they should give, and only suffers want.” Proverbs 11:24

- Cultivate a heart of generosity. Jesus wants your heart, not just your money. Establishing a percentage of income for giving is helpful, but giving should also be voluntary, generous (even sacrificial), cheerful, and needs-based (2 Corinthians 9:7).

- Do not wait until you’re making more money. Giving is an opportunity to break us free from the love of money (1 Timothy 6:10). Generosity will not be easier when it is a higher dollar value; start today.

- Tread Wisely with Debt – “The rich rule over the poor, and the borrower is slave to the lender.” Proverbs 22:7

- Avoid the use of debt. Treat your credit card like a debit card and pay it off every month. Pray, plan, and tread wisely when you are thinking about taking on debt, especially for depreciating assets. Debt can be burdensome, both financially and emotionally.

- Work towards eliminating debt. Create a debt repayment plan if you are in debt. Work towards eliminating all high-interest, short-term debt, then consider the “snowball” method of debt repayment which targets the smallest debt balances first in order to build momentum and additional cash flow margin early to aid you in your debt repayment plan. Knocking out the smallest debt amounts first helps create the snowball effect of debt repayment.

Remember, God owns everything. “You may say yourself, ’My power and the strength of my hand have produced this wealth for me.’ But remember the Lord your God, for it is He who gives you the ability to produce wealth, and so confirms his covenant, which he swore to your ancestors, as it is today.” Deuteronomy 8:17-18

If we truly understand that God owns all things and we are simply stewards of His resources, our perspective on money should drastically shift. The Bible has over 2,300 verses on money and over 40% of Jesus’ parables are about money. God knew that money would be one of our biggest distractions away from Him! Stewardship begins today; being generous and making financially wise decisions will only become more difficult. You do not have to wait until you are far along in your career to implement sound disciplines with money.

At Blue Trust, we seek to provide clients with financial strategies based on biblical wisdom to help them on their financial journey. For more information, or to speak with a Blue Trust advisor, please call 800.987.2987 or email info@bluetrust.com.